When you open a new brokerage account, there’s a good chance they asked you for your risk tolerance.

Are you aggressive? Are you conservative?

Can you stomach a loss of 10%? 20%? 50%?

I believe these are stupid questions because they focus on the wrong things. And I have to believe that brokerages know this!

No one like losing money. Not a dollar and certainly not ten thousand dollars.

But risk tolerance is not about losing money or how well you can handle it. By phrasing the question in this way, they are leading you to believe that risk tolerance is about how tough you are. It taps into your pride and your dignity.

But that’s not risk tolerance. (why not ask if you can stomach a gain of 10% 20% 50%???)

Let’s talk about risk, risk tolerance, and what it means for your portfolio:

💵 Why do brokers ask for your risk tolerance? I don’t know for certain but I think it’s so they know what products and services to market to you. Buying index funds and holding them for a long time does not make them any money. Buying and selling options (opening and closing contracts) does make them money and that can be a more volatile (risky) investment strategy. Follow the money, as they say.

Table of Contents

What is Risk?

When people talk about risk, it’s really about the intersection of two factors.

When we talk casually about risky investments, we’re talking about investments with a big payoff if things go right and a big zero if they go wrong. A simple explanation but an accurate one.

For investments, risk is the investment’s price volatility. Risky investments are more volatile with bigger price swings. Big payoff or big zero.

That’s just part one. The second part is what we most often overlook – our time horizon.

The stock market will go up and down every single day. Whether you “make” or “lose” money depends on the decision to exit a position. You own shares in companies and those shares will always have a market value should you want to exit. If you’re able to hold, you can ride the volatility and, as history has shown, enjoyed it’s general trend upward.

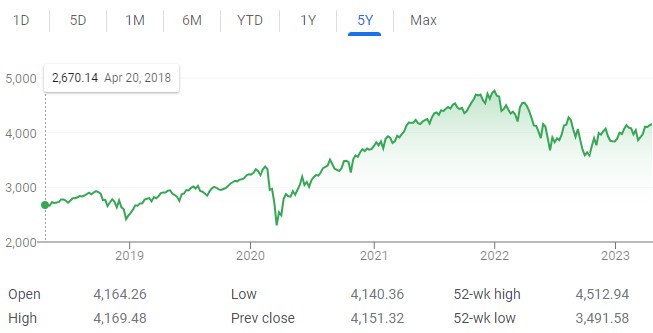

The above chart shows you the 5 year price chart of the S&P 500. It’s bumpy because it’s volatile… and this is the 30,000′ view! It’s even bumpier if you zoom in.

There were times in that chart that you would’ve lost money if you sold your shares. There are times you would’ve made money if you sold your shares. The market is volatile but it only affects you if you are pushed to make decisions, whether by your environment (eg. you need that money) or your emotions (eg. you decide to sell).

Our risk is the melding of the two factor – market volatility and your time horizon.

The best place to see the difference in how time horizon affects risk is in a casino. The games of chance in a casino are risky for the player and not at all for the house. You have the same volatility (OK, house has a slight edge) but different time horizons. The player has a time horizon of one hand, one roll, or one spin. The house has an infinite time horizon. The house always wins.

Your advantage as an investor is in your time horizon because with the stock market, you have the edge. The stock market is biased to go up for a variety of reasons, known and unknown – inflation, population growth, technology improvements, interest rates, etc.

Time takes an asset that is risky in the short term, because of volatility, and makes it far less risky in the long term.

How to Manage Short-Term Volatility

There’s risk tolerance and then how you tolerate risk (volatility).

When things are great, we feel like we can tolerate quite a bit of risk. Sure, the market can go down… but how we deal with it when it happens is another matter.

We inherently understand that we should be more aggressive when we are young and more conservative as we get older. The rule of thumb of 120 minus our age is a good example of this. Take 120 and subtract your age. That’s the percentage of your portfolio that should be in stocks. The rest should be in bonds.

The rule doesn’t teach us how to deal with the short term volatility swings. Nothing except experience prepares you for it.

I chose to deal with it using a simple trick – I “buried” my money into time capsules. I don’t look at them. (OK – I would rebalance, as necessary, but otherwise I wouldn’t check them)

I don’t watch or read financial news on a daily basis. I subscribe to a few newsletters to get the headlines but that’s it.

If you watch financial news to try to “educate” yourself, you are making a big mistake. Those television shows are built for entertainment. When things are bad, the screen is all red, pundits are talking about markets tanking, and it’s easy to fall into the loss aversion trap of having to do something about it.

It’s in these panic moments that you feel like you have taken on too much risk… but you haven’t. This is all part of the process and you must lean on your time horizon for strength. Given enough time, your portfolio can weather the storm. It won’t kill you.

Another benefit of this strategy is that over time, you will have weathered several of these storms and it will seem normal. They will be less and less painful and it’ll be easier to navigate them.

Bad Decisions Are Often a Mismatch of Risk

How many times have you looked at your 401(k) after seeing the market went down that day? How many times did you feel like you should do something?

It’s human nature. It’s loss aversion.

But you can’t access your 401(k), outside of a few special scenarios, until your retire. If you access it early, you pay a big 10% penalty. Your time horizon, when you set up the account, was long. You didn’t intend to use that money until you retired – in how many years is that?

If the answer is over 10 years, you should only check your 401(k) a few times a year – to rebalance and to adjust your contribution amounts. If the answer is less, you should be planning for retirement and following that plan.

If you look at it more often and start making decisions, there’s a mismatch. You aren’t treating it like you would if you fully accepted the time horizon and buried the time capsule.

The Great Recession recovered in six years and it was a huge systemic shock to our financial system. 10% corrections (drop in value in the stock market) are common. (more surprising investing facts)

As long as you’re still in the game, you’re OK.

Why Diversification Is Important

There are a lot of technical reasons why diversification is important. The most important of which is that by diversifying your investments, you can achieve a greater rate of return while taking on less risk. In financial terms, you’re increasing the risk-adjusted returns of your portfolio.

That’s great.

But I think diversification plays another important role. When you diversify your investments, you try to pick investments that aren’t completely correlated. This means they don’t go up and down together.

More importantly, this means that when one goes down a lot, the other doesn’t go down a lot too.

This can buoy you in times of turmoil. This is even better if the asset isn’t publicly priced every day (or second, in the case of the stock market).

Real estate is a popular alternative investment for this very reason. Real estate is often local, though it is affected by national events (such as interest rates, the economy, etc.), but it isn’t marked to the market every day. You don’t have a ticker showing you the daily price of your real estate holdings.

You know how I said you shouldn’t check your portfolio every day? With real estate, you can’t and that’s usually a good thing.

How Do We Accurately Assess Our Time Horizon

The volatility of the market is what it is, so really we need to focus on how do we accurately assess our time horizon?

I don’t have the answers for everyone but this is how I did it.

First, we must be clear on our time horizon for each of your accounts.

With a 401(k), the time horizon is clear – we won’t access it, unless under extreme duress, until retirement. When you’re twenty-something years old, that time horizon can be counted in decades. As we age, the horizon gets closer but it’s still quite far.

With a taxable brokerage account, the time horizon is less clear because there’s no penalty for early access. Your taxable brokerage account must have a time horizon of at least five years. That’s a minimum.

There’s no rule or data that says five years is the ideal time frame. That’s my personal opinion and you can adjust this based on your financial situation. I chose this because one of the biggest financial catastrophes, the financial crisis and Great Recession, recovered in about 6 years.

Next, we can support this five year timeframe by what we do outside of the taxable brokerage account. Do you have some cash in a savings account or in certificates of deposit? Those are your near term savings that you can draw upon for savings goals, emergencies, etc.

With your near-term savings in “safe investments,” the volatility in your investments won’t have the same near term sting because you have your savings as a moat. You don’t “need” that money.

It’s never going to feel good to see red in your portfolio and realize you “lose “lost” $1,000 or $5,000 or $10,000 (or more). But as it happens more and more, you’ll get used to it because you’ll also see the paper gains as well. Just make sure that your money is invested in the proper assets for the time horizon and you’ll be set.

The ups and downs will always happen.

It’s all part of the emotional game of investing.