The term “IPO” – or initial public offering – is well known to the wealthiest of investors, and for good reason. Investing in this asset class has traditionally been limited to financial institutions and wealthy private investors. But in recent years, it’s become possible for regular folks to get in on the action, too.

There’s a lot of fanfare around IPOs, especially when they involve buzz-worthy private companies going public. If you can get in early, the potential for profits is significant, but the downside risks are as well. It’s important to know about both before taking the plunge.

Investing in IPOs is not only more complicated than investing in established companies, but it often requires a longer time horizon as well. That’s why it’s essential that you learn all you can about how to invest in startups and pre-IPO private companies before you get started.

Table of Contents

- Why Invest in Startups & Pre-IPO Private Companies?

- 3. Investment Diversification

- How to Invest in Startups & Pre-IPO Private Companies

- How to Find Startups and Pre-IPO Private Companies to Invest in

- Where to Invest in Startups & Pre-IPO Private Companies

- The Risks of Investing in Startups & Pre-IPO Private Companies

- Final Thoughts

Why Invest in Startups & Pre-IPO Private Companies?

At its core, an IPO is a process that takes place when a privately held company decides to go public and issue stock on popular exchanges.

Though most companies taking this step qualify as startups, having been in business for five years or less, some very well-known companies were held privately for many years before going public. For example, Facebook – now Meta – started in 2004 but didn’t launch its IPO until 2012.

At some point, owners of those businesses decide to take their companies public. It allows them to raise large amounts of capital in the financial markets while the owners increase their own wealth by selling stock to the general public.

Here are three major reasons why you, as an individual investor, might want to invest in IPOs:

1. Profit Potential

While growth stocks generally outperform the overall market over the long haul, newly issued stock in startup companies can perform even better.

That’s because you’re getting into the stock before it becomes widely accepted in the investment community, and especially among large financial institutions. Think of it as getting in “on the ground floor.”

IPOs offer one of the best opportunities to find the coveted “10 baggers”. That’s a stock you buy for, say, $10, then sell for $100 a couple of years later.

These days, IPOs often involve technology companies. Naturally, everyone’s on the lookout for the next Apple, Netflix, or Intel, to get in on the action early when the profit potential is at its greatest.

Even though companies can remain profitable after their stock has gone public, the profit potential is greater when you can buy during the pre-IPO phase, as company owners begin selling shares to investors in advance of the public offering.

2. A Quick Kill

Not only can IPOs be incredibly profitable, but they can also achieve those gains in less time than it takes for more established companies.

For example, a well-received IPO stock price can jump from $20 to $100 in just a few months or weeks. That would represent several years of gains in a typical index fund or even a well-established company stock.

Make the right IPO pics, and you won’t have to wait for big profits.

3. Investment Diversification

The majority of stocks tend to be market sensitive. That is, when the market rises, an individual stock will rise as well. And when the market falls, the same stock declines.

The correlation isn’t exact, and in that, the stock will move in lockstep with the market each and every day. But it is a clear trend with many stocks over longer time frames.

Since IPO stocks tend to run on their own course, it’s possible for one to be a winning investment even during a general decline in the market. This makes IPOs a fairly reliable diversification to a typical investment portfolio composed mostly of stocks and bonds.

How to Invest in Startups & Pre-IPO Private Companies

Startup & pre-IPO investing was a process once reserved for accredited investors. These are investors who meet certain minimum income and/or net worth qualifications and are deemed to have the wherewithal to engage in high-risk investing, like IPOs.

That all changed in 2012 when then-President Barack Obama signed into law the Jumpstart Our Business Startups (JOBS) Act. That law made it possible for small investors to participate in IPOs and other investments deemed to be higher risk.

As a result, several brokers and other financial platforms offer IPOs to non-accredited investors, many of whom we’ve included on our list later in this article.

How to Find Startups and Pre-IPO Private Companies to Invest in

You can take the scattershot approach by keeping your eyes and ears open to announcements of IPO activity. But if you’re serious about taking the plunge, you can find entire listings of upcoming IPOs on certain crowdfunding platforms.

Available IPO issues can be found with online brokers and platforms that offer these types of investments.

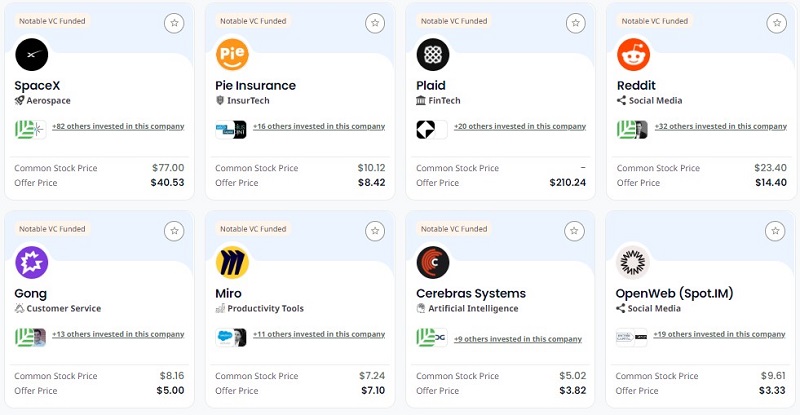

For example, below are opportunities available on the EquityBee platform at the time of this writing:

They are:

- SpaceX

- Pie Insurance

- Plaid

- Gong

- Miro

- Cerebras Systems

- OpenWeb (Spot.IM)

Every broker platform will have its own list of upcoming deals. As you’ll see in the next section, some brokers allow you to invest in individual companies, while others offer participation in IPO-related funds.

Note that the number of IPO deals available will vary by platform. One may have just a few offerings, while another offers 35. Those numbers continually change as the IPO market is highly fluid. Some deals fall off a list once they go public, while new offerings are added.

Choosing the Right IPO

One of the most critical aspects of any investment is choosing the right companies to invest in. This is just as true with IPOs as it is with stocks of existing companies.

But this is where investing in IPOs becomes more complicated than your average investment.

Remember, an IPO describes a company that has not yet gone public. And more often than not, it’s a small company operating under the radar of the mainstream financial media. This means information about the company, as well as its business track record, may be subject to limited availability.

Though there is no guarantee of success, you can increase the likelihood of a profitable trade by following these guidelines:

1. Choose a company with a winning product or service.

The company should be involved in a rising technology or market sector. It should offer products that represent measurable improvements over existing product lines at an attractive price point.

2. Review the legal documents.

Many pre-IPOs must be registered with the Securities and Exchange Commission (SEC) or their home state securities regulator. If the company is registered with the SEC, they’ll be required to file a prospectus and Forms 10-K and 10-Q.

A prospectus provides information about the company, its management team, recent financial performance, and other related information. Form 10-K provides a comprehensive annual overview of the company’s business and financial condition and includes audited financial statements, while Form 10-Q provides quarterly updates.

If those documents are available, obtain copies, and examine them carefully. That will help you become familiar with the company and its operations.

If the company files documents with the SEC, you should be able to access them through the Electronic Data Gathering, Analysis and Retrieval System (EDGAR).

3. Evaluate the company’s track record.

Look for companies with a demonstrated track record of steadily increasing revenues and earnings. Since these are largely startup companies, you should expect to see growth rates that exceed more established companies within the same industry.

That growth will be critical to the profitability of your investment, particularly if the expected return doesn’t pan out as quickly as you anticipate. Past growth is never a guarantee of future growth, but it will provide a greater likelihood of market acceptance after the stock goes public.

4. Limit Your Exposure

As we’ll discuss in just a bit, IPO-related investing is high risk. Even though there is considerable profit potential, the risk of losing your entire investment is just as real.

For that reason, you should limit your IPO investments to no more than 5% to 10% of your portfolio (or no more than you’re prepared to lose.)

The remainder of your portfolio should be invested in conventional assets, like stocks, bonds, funds, real estate, and other fixed-income investments.

You should also establish strict limits on individual IPO investments. For example, if you decide to allocate 10% of your investment portfolio to IPOs, you may want to set a secondary limit of no more than 2% for any individual IPO.

If the investment turns out to be at 10-bagger, your stake will grow from 2% to 20% of your portfolio. That will provide an impressive overall gain for the portfolio. But if the investment blows up, you’ll be out no more than 2%. Put another way; a small investment will be enough for you to reap big gains while preventing outsized losses.

Where to Invest in Startups & Pre-IPO Private Companies

There are a large number of platforms where you can invest in startups and Pre-IPO private companies. Some are well-known brokers or crowdfunding platforms, while others are more specialized and less familiar.

I’m not recommending any specific platform. Instead, use the companies listed below as a starting point for your search.

As you can see, the requirements and offerings of each company varies substantially from one to another. Concentrate your search on those that most closely match your own investor profile and preferences.

| Platform | Accredited Investor Required? | Minimum Investment | Fees | Asset Class |

|---|---|---|---|---|

| Fundrise – Innovation Fund | No | $10 | 1.85% per year | Late stage private high-growth technology companies |

| Titan – ARK Venture Fund | No | $500 | 2.75% annual management fee | Fund of public and private companies |

| SoFi Invest | No | No minimum | None indicated | IPOs & SPACs*** |

| TradeStation – Renaissance IPO ETF | No | No minimum | None indicated | IPO fund |

| Webull | No | No minimum | None indicated | Funds & individual companies |

| LINQTO | Yes | $10,000 | Annual Introduction fee approx. 0.50% | Pre-IPO stocks |

| E*TRADE | No, but must pass an investor profile |

No minimum | None indicated | IPOs – equity& fixed income |

| EquityBee | Yes | $10,000 | 5% platform fee + 5% carry fee upon liquidation | Pre-IPO for startup employees & investors |

| EquityZen | Yes | $10,000 | 5% up to $500K; 4% up to $1 million; 3% > $1 million | Pre-IPO in private technology companies |

| Republic | Accredited and non-accredited offers | $50 (maximum is based on your financial status) | None indicated | Start-ups |

| Forge | Yes | $100,000 | 5% >$100K; higher fee if <$100K, but varies by investment | Pre-IPOs in technology companies |

***Special Purpose Acquisition Companies are shell companies that go public with the intent of buying private companies.

The Risks of Investing in Startups & Pre-IPO Private Companies

IPO investments are hardly risk-free. Some of the risks you should be aware of include:

Risk of loss. As is the case with any investment, there’s always the risk of losing some or all of your investment. Unfortunately, many IPOs go sour, despite the glorified tales of the winners that echo throughout the investment universe. That’s why you need to maintain adequate portfolio diversification and keep your investment in any single IPO to an absolute minimum.

Market risk unique to the IPO market can be a factor. While it’s true that IPOs can be profitable even during a general stock market decline, the market for IPOs themselves can be a bit clouded. This can happen in a complicated financial environment, much like that of today, where interest rates are rising rapidly, causing uncertainty.

Timing risk. You should also understand that IPOs can be long-term investments. It can take several years from the initial investment until an IPO is completed. The trend in recent years has been toward longer-term IPOs, so this is a situation to be aware of. You’ll need to tie up your capital for as long as it takes for the IPO to complete.

Liquidity risk. Along the same line, IPO investments can be illiquid. Once you commit money to an IPO, you may be stuck until the process is finalized. While some platforms do allow for early liquidation, it’s often partial and comes with high exit fees.

Fees. As you can see from the table above, many platforms charge upfront or annual fees or both. The combination can whittle away at your investment if the IPO takes several years to complete.

Final Thoughts

IPOs have incredible profit potential, well beyond that of established investments. But they also carry considerable risk. You should understand the risks inherent in all IPOs, as well as those unique to each investment you make.

You should also limit your exposure to IPOs to further minimize those risks. And if you’re thinking of investing, make sure you consult an investment advisor before doing so.