If you have a checking or savings account at a large brick and mortar bank, you’re making nearly nothing in interest.

The rates are abysmal… and they know it.

They will never increase it.

They expect some of you to keep your cash there and they boost their profits.

They also expect the savvier customers to move your money.

The industry term is “cash sorting,” when people realize they’re earning nothing on their cash and move them into higher yielding assets. Banks expect you to move it to a money market account or to invest it, but they’re not really trying to encourage you to…

… because when you leave it in there, they’re happy to get that money and pay you nothing for it!

Table of Contents

Banks Expect You To Be Lazy

Banks make a lot of money off paying 0% interest rates.

Why pay you more when they can pay you less, right?

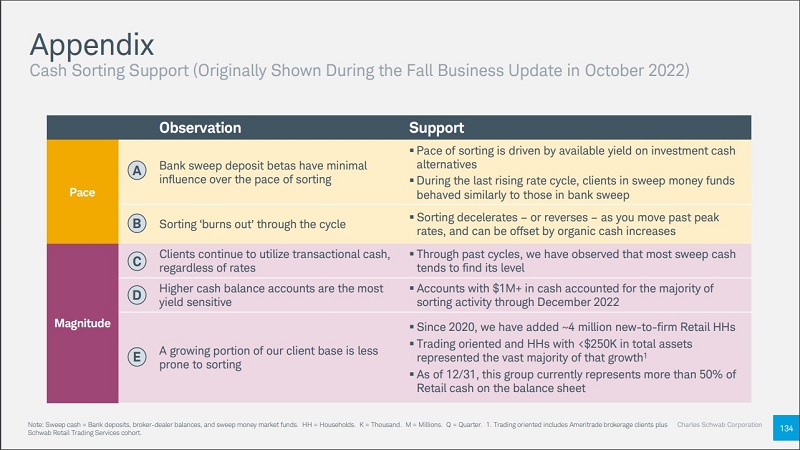

Check out this banger of a slide from Charles Schwab’s 2023 Winter Business Update (slide 134):

Once you get past the idea that “higher cash balances” are those with over a million in cash (wow), you realize that banks expect you to find higher rates as interest rates go up. But they won’t help you do it if your cash is already in a low yielding account.

Larger user behavior then shows that then the sorting decelerates or reverses when we hit peak rates. We haven’t hit peak rates yet, as we expect the Fed to keep raising interest rates (albeit at a slower rate than in the last few meetings).

I learned about this slide from fellow blogger Jonathan at MyMoneyBlog in which he noted that Charles Schwab’s default cash sweep pays an abysmal 0.45% APY as of the end of February 2023. Vanguard’s default is a money market account that had an SEC yield of 4.52% APY during that same period.

Schwab could’ve made the default something better… but they don’t because profit!

Where You Should Put Your Money

But you’re not a fool, even if you don’t have a million dollars cash in the bank account (if you do, congratulations! now get it out of there you fool!).

At a bare minimum, you should be in a high yield savings account at an online bank. Brick and mortar banks can’t compare and there are plenty of safe investment options that crush 0.01% APY. 😉

If you’re looking to make a move, consider one that will give you a bank bonus on top of a higher yield.

Otherwise, any of the banks on our list of the best high yield savings accounts will do just fine.

Once you have done that, consider putting your money into a certificate of deposit. You can go with a 12-month CD for the short term or even a no penalty CD for maximum flexibility. We’re seeing rates over 5% on these, though I suspect we may soon see 6% CDs in the near future (but not yet, as of early March).

If you want to get even fancier, you can look into Treasury bonds and bills. You can buy those directly through your brokerage or get a Treasury Account at Public to do it for you. Public works with Jiko Securities to buy Treasury bills (4-week to 1-year maturities) and starts at just $100. This is not technically FDIC insured but they are Treasury bills so backed by the full faith and credit of the United States.

Don’t Chase Interest Rates

If you’re getting 0.01% APY, you should change banks if you can get more. The best high yield savings accounts are, as of March 2023, over 4%. That’s worth your time.

But if you are getting 4.00% APY, don’t switch banks to get 4.05% or even 4.25%. You should be spending your time on bigger problems. (also, you often lose the difference in the time your money isn’t in the account)

You just want to make sure you’re in the right category – once you’re in a high yield savings account, you’re good to go.

Now, if you’re deciding on whether or not to renew a CD or something like that, of course go with the higher rate because you’re going to have to take action anyway. You have to decide what to do so you might as well get the higher rate.

But if you’re sitting on a decent rate, spend your time optimizing something else.

Find the Right Investment

When banks talk about cash sorting, they typically mean moving money from one type of account to another. They’re all considered cash or cash equivalents but sometimes this means money market accounts, certificates of deposit, or some other safe yield.

This isn’t necessarily how you should think about it though.

You may be holding too much cash.

I can’t tell you how much cash you should have but you should review your financial plan and see if some of that cash should be invested in something with greater potential for gains.

For example, it’s fine if your emergency fund is put into something that is fairly liquid – like a money market fund or certificate of deposit. But I think we’d all agree that those would be terrible options for your retirement fund.

But then there’s the stuff in between – money you don’t need for 5-10 years (or more). That bucket of money should be invested.

This is your nudge to do something!