If you prefer individual stocks and ETFs for short or long-term trading, investment research tools like Ziggma can help you find the best stocks for your portfolio.

Ziggma provides in-depth research through a free stock screener and portfolio tracker. The platform also has several premium tools, including proprietary stock ratings, a portfolio simulator, and backtests.

Our Ziggma review tests out the various features of this stock analysis tool so you can decide if it deserves a spot in your investment toolkit.

Table of Contents

What Is Ziggma?

Ziggma is a multi-faceted stock and ETF research tool with over 20,000 users and $1 billion in linked accounts.

Casual investors will appreciate the free stock screening and portfolio tracking tools that can provide more details than a basic online search, not to mention most online brokers. The free membership also doles out the propriety Ziggma Score for stocks, Climate Scores, and a dividend tracker.

While this service doesn’t provide monthly stock picks like an investment newsletter, a paid membership ($9.90/month or $89/year, after a 7-day free trial) includes the Top 50 Stock List, guru, and model portfolios you glean investment ideas from. There is also a hands-on portfolio simulator and backtesting to try different strategies.

How To Use Ziggma

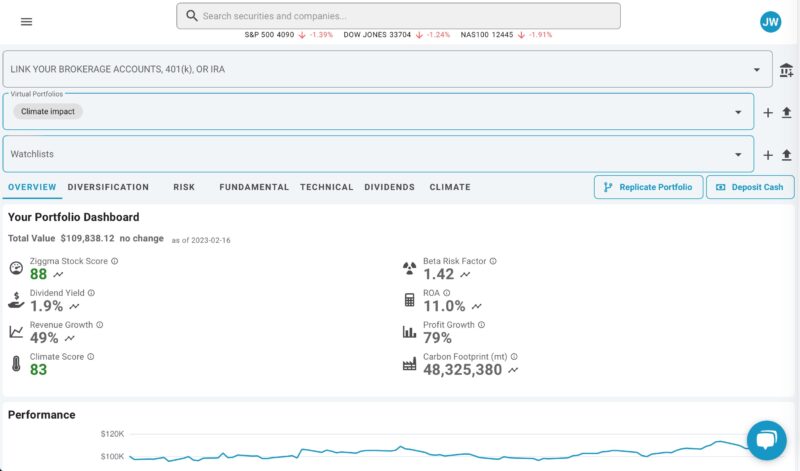

Ziggma’s research platform is easy to use and provides in-depth fundamental and technical data. You can link your investment accounts using Plaid to view your daily balance, historical performance, and scores for your current holdings.

You can create a virtual portfolio if you don’t want to link your accounts or prefer to paper trade. There are various tabs and drop-down menus to access the various research tools we’re highlighting below.

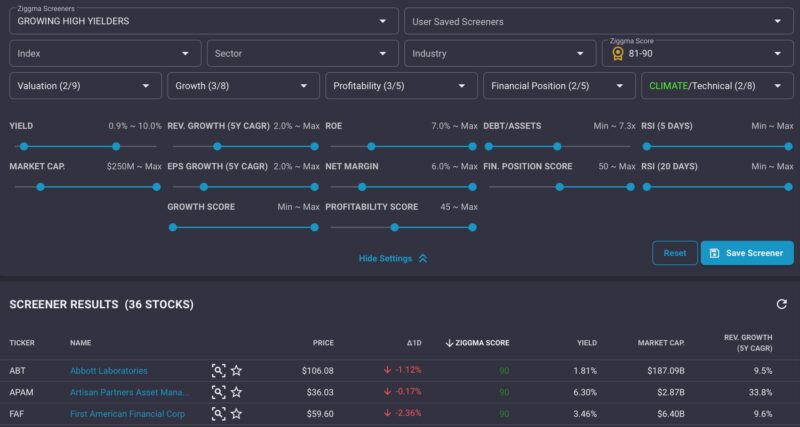

Ziggma Stock Screener

All users can utilize the in-depth stock screener to filter through an expansive list of stocks and ETFs. There are multiple customizable filters you can employ to narrow down your search results. It’s also possible to use premade screens and save DIY screens.

The screener filters include the following:

- Index

- Sector

- Industry

- Ziggma Score

- Valuation (9 metrics)

- Growth (8 metrics)

- Profitability (5 metrics)

- Financial Position (5 metrics)

- Climate/Technical (8 metrics)

Premium members can also sort results via overall score for a specific category, such as growth or valuation.

There is a slider bar to choose the minimum and maximum criteria for the various growth, profitability, valuation, financial position, and technical indicators. Any securities that pass the screen appear in a list below.

Other stock screeners provide more filters, but this one is detailed enough to satisfy most traders.

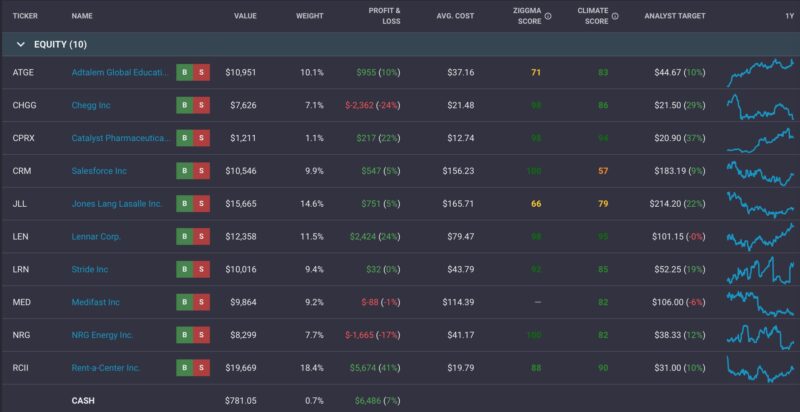

Portfolio Tracker

The portfolio tracker makes it easy to track the performance and key performance indicators (KPIs) of your holdings. In addition, it’s possible to link multiple brokerage accounts to see your asset performance and portfolio weight in one place.

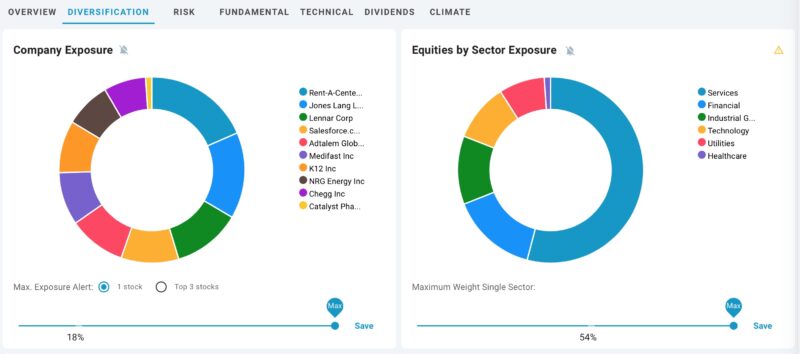

You can also view in-depth scores for these factors:

- Diversification

- Risk

- Fundamental

- Technical

- Dividends

- Climate

Ziggma goes into significantly more depth than a barebones free investing app like Robinhood, M1 Finance, or Public, which make it easy to invest but are limited when it comes to research and account monitoring.

Investors who prefer fundamentals over technical data should find this platform desirable. Dividend investors will appreciate the colorful graphs, which make it easier to project your portfolio dividend yield and track recent payments.

Portfolio Analyzer

In addition to tracking your investment performance, Ziggma can help evaluate your asset allocation and portfolio risk. You won’t receive personalized insights as with some other analyzers, but you can inspect your portfolio from several different viewpoints.

The platform provides observations, and you can hover your mouse icon over a yellow triangle to view the potential warning. For example, Ziggma will let you know which sectors your portfolio doesn’t have exposure to.

Premium members can schedule Smart Alerts for situations like:

- A single position exceeds a specific percentage of your portfolio allocation

- Portfolio drift from a sector or asset class

- A stock trades at a specific price

- An asset’s PE ratio or dividend yield changes

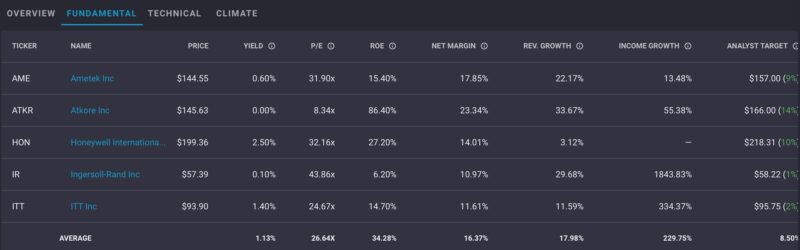

Fundamental Metrics

You can quickly evaluate a company’s financial health using the fundamental KPIs. These readings can help you determine how the share price relates to the P/E ratio and profitability metrics.

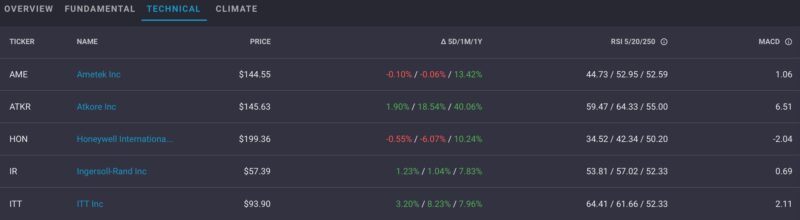

Technical Analysis

The upfront technical indicators let you quickly see the recent price performance, RSI reading, and MACD. These metrics can help you decide if the stock is overbought, oversold, or market neutral and whether it might be in an uptrend or downtrend.

You can also use interactive stock charts for in-depth technical analysis when inspecting a single stock.

Climate Score

Ziggma places a noticeable emphasis on a company’s environmental impact. You can view the current score and three-year emissions trend for your portfolio and individual stocks.

Stock Analysis

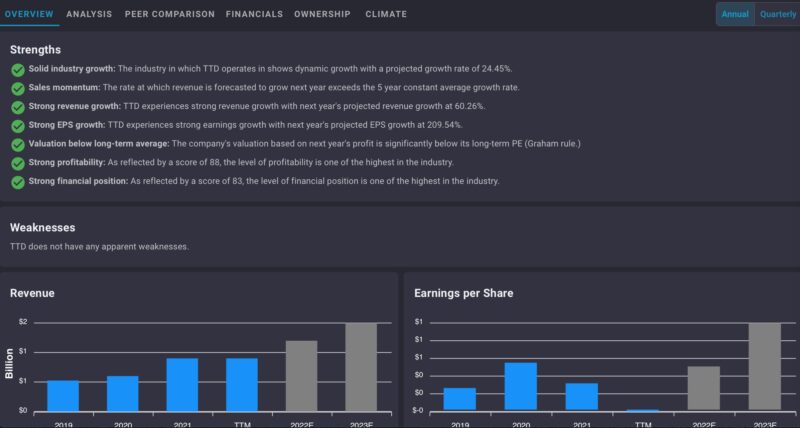

You can dig deeper into any publicly-traded stock or ETF to view its historical performance and key performance indicators. Most equities have a Ziggma Score that can quickly summarize how it compares against their peers, but you can also view the underlying data.

There is also an interactive price chart powered by TradingView, so you can add indicators if you like reading stock charts.

In-Depth Analysis

Ziggma’s analysis tool allows you to research in-depth statistics for these categories:

- Overview: Company strengths and weaknesses and financial charts

- Analysis: Ziggma Score metrics of growth, valuation, profitability, balance sheet liquidity

- Valuation: Balance sheet metrics such as income statement and cash flow statement

- Ownership: Insider buying and selling transactions

- Climate: Climate Score, carbon intensity, and comparison to peers

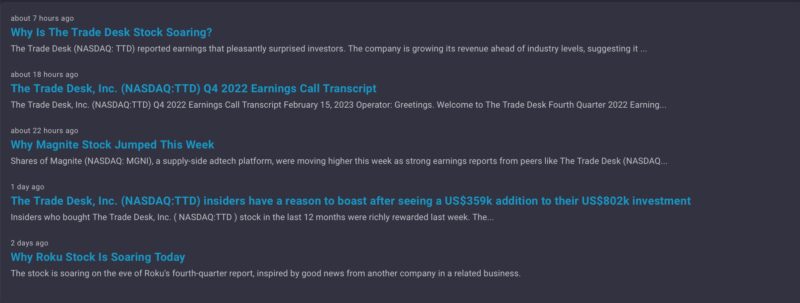

Investment News

Ziggma also aggregates news article links for the assets you’re researching. It’s a helpful tool but isn’t as robust as the other analysis tools. In addition, you don’t receive access to analyst reports.

Ziggma Score

Several stock research tools have a proprietary score to rate an equity’s current investment potential. The Ziggma Stock Score uses institutional-grade metrics in these categories to generate a rating:

- Growth

- Profitability

- Valuation

- Financial health

A score closer to 100 indicates a healthier stock.

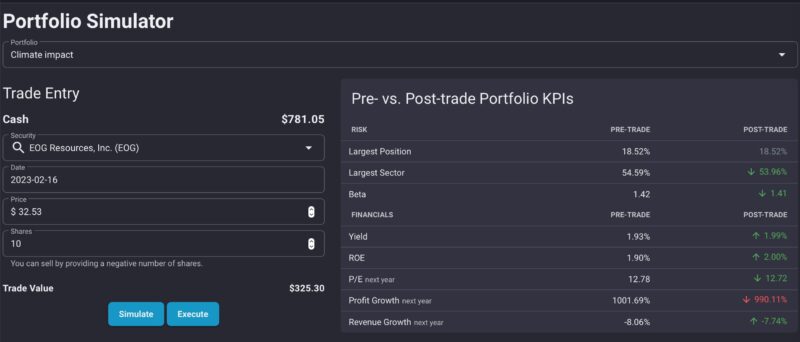

Portfolio Simulator

Before buying stock, you can see how the trade will change your portfolio makeup. The quick comparison lets you view your exposure to the largest position and sector. You’re able to estimate the yield and other financials too.

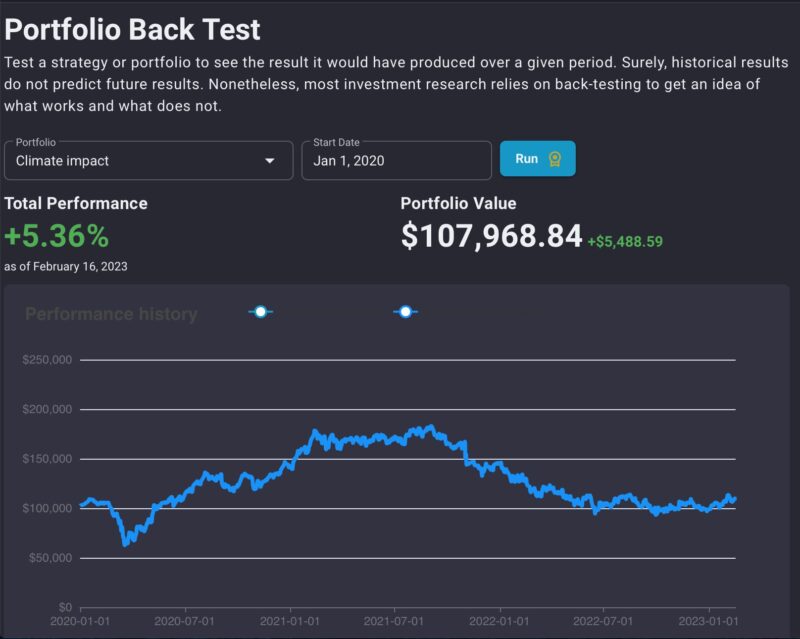

Portfolio Back Test

You can evaluate how your virtual portfolio would have performed over a specific period using Ziggma’s Portfolio Back Test feature. It won’t predict future performance, but you can see how a strategy would fare had you pursued it sooner or during a specific market situation.

Investment Ideas

As mentioned, Ziggma doesn’t provide stock picks like a stock newsletter, but premium members can access model portfolios and guru portfolios to find many investment ideas at an affordable price.

Top 50 Stock List

The Ziggma Top 50 Stock List ranks five stocks in the ten fastest-growing industries on a daily basis. This tool can be a time-saving sidekick to the stock screener when you’re looking for the best stocks to buy now.

Model Portfolios

Ziggma has several thematic portfolios that track stocks and funds for a specific strategy. Some of them include:

- 60/40 Climate Impact Portfolio

- Best-In-Class REITs

- Growth on High Margins

- Sustainable High Yield

- Ultra-Profitable and Fortress Balance Sheet

You can also use the stock screener to find companies within a portfolio to research further.

Guru Portfolios

You can also track the performance and create a portfolio based on popular hedge funds, such as:

- Berkshire Hathaway (Warren Buffett)

- Bridgewater (Ray Dalio)

- Greenlight (David Einhorn)

- Pershing Square (Bill Ackman)

- Trian (Nelson Peltz)

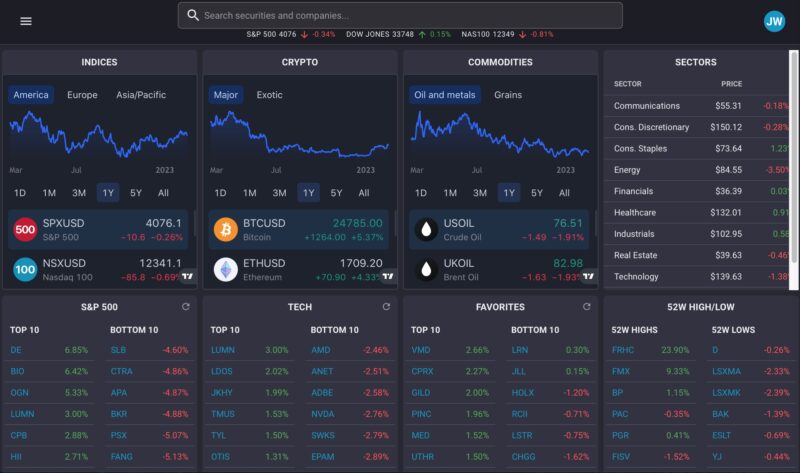

Big Board

The Big Board feature displays the top 10 and worst 10 performing stocks by index and sector. This feature is available to all members and is a practical alternative to heat maps that some screeners use.

How Much Does Ziggma Cost?

Most Ziggma features are free, but a paid subscription is required to access every indicator and portfolio analyzer tool. Further, the Top 50 stock list and premade portfolios are exclusive to premium members.

Ziggma Free

The free plan is sufficient if you want a screener and investment tracker and don’t need all the extra data or model portfolios.

All users can access these features:

- Portfolio tracker

- Stock and ETF screener

- Stock scores

- Climate scores

- Financial data

- Big Board

- Market news

Ziggma Premium

A paid subscription costs $9.90 monthly or $89 when billed annually ($7.42/month). You can enjoy a seven-day free trial before paying for the service.

The Premium features include:

- Full access to Ziggma Score

- Top 50 Stock List

- Model portfolios

- Guru portfolios

- Portfolio simulator

- Back-testing

- Smart Alerts

- Save search screens

Ziggma Pros and Cons

If you’re unsatisfied with the research tools offered by your online brokerage account, Ziggma offers plenty of helpful free tools. Here is my list of Ziggma’s pros and cons.

Pros

- Plenty of free research and tracking tools

- Portfolio simulator and backtesting

- Links to most brokerage accounts

- Lots of fundamental data

- Top 50 stock list and model portfolios

Cons

- Cannot directly trade within the platform

- Doesn’t provide stock picks or personalized guidance

- Other stock screeners may have more filters

Ziggma Alternatives

Before signing up with Ziggma, it doesn’t hurt to check out the competition. The following stock research platforms can also be effective in finding investment ideas and monitoring your portfolio performance.

Stock Rover

Stock Rover is one of the best stock screeners as it covers most stocks and ETFs with thorough fundamental analysis. Its free plan is good for basic screens, and several different paid plans unlock various research tools and model portfolios. For more details, read our Stock Rover Review.

Seeking Alpha

Consider Seeking Alpha if you prefer reading analyst commentary, as most stocks and funds have bullish and bearish articles. You can also access similar fundamental and technical data during the research process. The Seeking Alpha rating is similar to the Ziggma Score system for proprietary ratings similar to what investment institutions apply to stocks.

Seeking Alpha also has a robust portfolio tracker and stock screener. However, the free version is somewhat limited and only good if you plan to research a couple of monthly stocks. For more information, check out our full Seeking Alpha Review.

Learn More About Seeking Alpha

TipRanks

While Ziggma provides lots of data, TipRanks provides more and is a better fit for traders and those relying on technical analysis. You can follow stocks and receive updates when research firms adjust their buy, sell, or hold ratings.

Unfortunately, there isn’t a free plan, although there are two paid plans. The entry-level Premium plan costs $30 per month, which is pricey, but you can access more expert opinions and data metrics. Learn more in our TipRanks Review.

Should Investors Use Ziggma?

Ziggma offers one of the best free stock screeners, and its research tools are also valuable if your online brokerage doesn’t offer in-depth fundamental and technical metrics. This service is also helpful if you have multiple investment accounts and want to track your overall performance and asset allocation easily.

Upgrading to the paid plan is worth it when you want to dig deeper into the Ziggma Score factors, access the Top 50 Stock List and model portfolios, or save your stock screens. The premium plan is also necessary for the portfolio simulator and back-tests.

This service isn’t the best fit if you like reading analyst reports for bullish and bearish viewpoints, as Ziggma only presents the research data. That said, you can find out about companies’ strengths and weaknesses, and the Ziggma Score can help you decide if a stock or ETF is trending in the right direction.

Ziggma

Strengths

- Plenty of free research and tracking tools

- Portfolio simulator and back testing

- Links to most brokerage accounts

- Lots of fundamental data

- Top 50 stock list and model portfolios

Weaknesses

- Cannot directly trade within the platform

- Doesn’t provide stock picks or personalized guidance

- Other stock screeners may have more filters