If you want to build wealth, one of the best ways is to invest in the stock market.

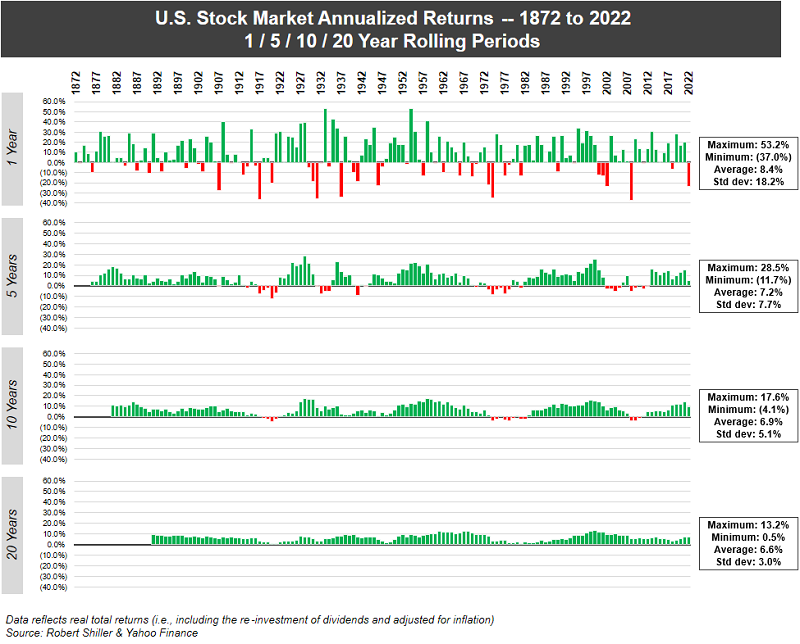

The average return of the S&P 500 over the past 151 years has been 8.4%1.

The numbers get even more impressive if you look at rolling periods of 5, 10, and 20 years.

In every 20 year rolling period, the stock market always has a positive return.

Why is this the case?

Why is the stock market, especially over longer periods, so good at growing?

Let’s figure it out.

Table of Contents

Is it the Growing Economy?

The stock market is not the economy but you’d expect the economy to have a huge impact on the stock market.

When I say economy, I am referring to the Gross Domestic Product (GDP). The GDP generally goes up (when it doesn’t, we call it a recession) and we’d expect it to go up with it.

When we look at the GDP from 1947 until October 2022, we see that growth pretty clearly:

Note the two most recent significant dips for the Covid-19 pandemic and the Great Recession.

Our intuition might tell us that a growing GDP means the stock market will grow, but that’s not necessarily true. In this research bulletin by MSCI Barra, they argue that the relationship is far too complex to draw that straight line relationship (also that the time period you analyze has a significant impact due to business cycles).

However, they do come to the conclusion that perhaps GDP acts as a cap on long-run stock market returns.

So while the economy likely contributes, it’s not the reason stocks go up each year.

Is It More Investors Each Year?

Our population is growing. Since our population is growing, we’d expect that we have more and more people joining the pool of total investors right?

A cynical way to think about this is to say the stock market is a Ponzi scheme in the sense that we have an increasing number of investors every year.

As it turns out, we may be growing but the percentage of Americans who own stock remains roughly the same.

How many Americans actually own stock? 58%.

And it was actually a higher percentage in the past.

Now, these statistics only look at polling data (so it’s a sample and not a true counting) and doesn’t include international or institutional investors, which make up a significant portion of the investor base (they have a beautiful chart on this). It doesn’t include pension funds and all the other non-person actors in the market (who also own a significant portion).

Of the $40 trillion in stock ownership in 2019, taxable accounts accounted for just $9.5 trillion.

Add that all up and the number of investors appears to matter very little because they make up such a small percentage of the investor pool.

Is It Inflation?

Inflation has been a hot topic in 2023 because of how high it is relative to recent memory. Inflation also means that prices go up and companies make more money.

Looking strictly at the numbers, and not at purchasing power, this seems like a huge tailwind for stock market prices. Are they going to go up because prices go up and earnings go up, even if the actual purchasing power decreases?

Inflation, to some degree, has a positive impact but if it’s too high, it’s bad. They increase the cost of goods sold by companies, they push the Federal Reserve to increase interest rates, which increases borrowing costs, etc. Inflation, if kept in a sweet spot, has a positive effect.

Too high and it’s bad news.

Inflation plays a role, like a rising tide, but it’s not the main reason.

Are Companies Just Good At Making Money?

As it turns out, public companies are good at making money.

There is a bit of a self-selection bias with companies in the stock market. They’re generally profitable and good at what they do.

A company that is losing money and not growing is not going to go public. A company that is public, with quarterly and annual reports and TV appearances, feels tremendous pressure to increase shareholder value.

Say what you will about whether it’s good for the company or society as a whole, this incentive structure means companies are incentivized to increase their share prices.

The main way they can do that is by increasing their earnings per share.

Here’s a look at the growth of earnings per share of the S&P 500 since 1871:

The earnings per share (EPS) continues to grow because companies get better at making money. EPS for a company can go up for a variety of non-business reasons, like share buybacks, but the long term trend is clear – they’re earning more per share.

This becomes even more acute when you look at only the S&P 500. They’re only going to pick the best companies and their selection criteria listed on the S&P 500 Factsheet is quite stringent.

In fact, if you don’t have an unadjusted market cap of $12.7 billion or more – don’t even think about it.

Oh, you also need positive earnings over the most recent quarter too. And the most recent four quarters summed together.

Conclusion

Much like how you don’t need to know how a combustible engine works to drive your car, it doesn’t matter why the stock market always seems to go up in the long run.

It does.

And to build wealth, just tie some of your money onto the back of that engine and go for a ride.

But make it a long one!

🚀🚀🚀