I’ve been following certificates of deposit for a while now. Yes, I’m a weirdo.

People love 12-month CDs and 60-month CDs (5 years) because they’re easy to think about. We like the 3-month, 6-month, and 9-month terms because they’re nicely spaced out.

Sometimes people will consider a 24-month CD too.

But lately banks have been doing something different – they’re offering terms that are a month or two more or less than “typical.”

I’m talking about those 11-month and 13-month CDs. Or the 15-month CD.

Why do banks offer this?

Table of Contents

It’s Mostly Marketing

There isn’t a big difference between a 12-month CD and a 13-month CD.

There might be a business major somewhere that can make the business case for the bank’s investors but for the consumer, they’re the same(ish).

At the level of tens or hundreds of millions of dollars in deposits, which is what banks care about, there’s probably some game you can play with interest rates to get make investors happy. But for you, it doesn’t matter.

Most of the value is in how it just looks weird.

We’re used to round numbers.

With CDs, it’s every three months (a quarter of the year) when you’re shorter than a month. Then you have the 12-month, 18-month, and 24-month CDs. Then it starts to go every year.

Here are the high yield CD terms from Ally Bank:

All typical terms lengths. But then check out their no-penalty CD – it’s a 11-month term.

They could do a 12-month term on a no-penalty CD but by making it 11-months, it looks a little more different than their standard offerings.

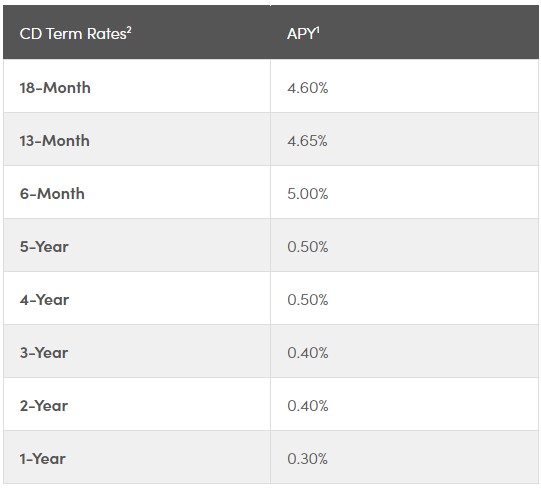

Then you have a rate table like what we see at CIT Bank:

The rates on the table aren’t as important as the trend – you have super low rates for all the “standard” terms. But for 6-month, 13-month, and 18-month, you see competitive rates.

6- and 18-month terms aren’t weird but their 13-month is definitely off “schedule.” They also have an 11-Month no penalty CD that yields 4.80% APY.

It’s just to catch your eye when they promote it.

1-Month CDs!?

Yep.

Then you have situations like Ponce Bank, through SaveBetter, with their 1-Month CD with a yield of 4.90% APY.

I suppose they get some certainty that they have the funds for a month while paying a higher interest rate. They also aren’t locked into that rate in case broader interest rates drop while still being able to advertise against other certificates of deposit.

But it’s mostly just eye-catching – when’s the last time you saw a 1-Month CD? I can’t even think of one.

🤔 If you aren’t familiar with SaveBetter, they’re a fintech company that works with banks to help them get deposits. Your account is managed through SaveBetter and they have partnerships with a lot of small regional banks that want to get deposits but don’t have the national reach (or budget). You can learn more about SaveBetter here.

Remember When It Matures

For those oddball CD terms, the only “gotcha” is to remember when the CD matures. Many banks will default to rolling over the CD into a new CD of the same term (or whatever is closest at the time it matures).

It’s not intentional, it’s just how CDs work.

If you’re used to your CDs maturing every 12 months and you chose an 11 month CD, you might forget and have it locked into another 11 month term. The bank will email you but you might miss it.

Most banks will let you determine what you want them to do with the CD when it matures. Do that at set up, or sometime shortly thereafter, and you won’t be surprised.

It’s a minor thing but still something to be aware of.

Should You Get These Odd Term CDs?

Sure – why not? There’s nothing inherently good or bad about the more commonly see terms.

With CDs, you’re putting in money you need in the near term. And you want that cash to be 100% safe.

The difference between a 11-month CD and a 13-month CD is miniscule. Pick the highest rate for whatever you think will be a comfortable time period and don’t spend too much time on it.

Or get a no-penalty CD for as long as you can and it’s essentially a savings account with a super high rate. You may have to press a few buttons to access the funds but you get a higher rate.

For example, Ally Bank is my primary bank and the online savings account currently offers 3.75% APY while the 11-Month no-penalty CD is at 4.35% APY. I can open a no penalty CD in just a few button clicks and get a slightly higher yield (my only restriction is I can’t close it within 6 days).

That spread isn’t worth opening a new account, transferring funds via ACH (which takes 3-5 days), and the hassle of an additional tax form. But for a few button clicks? Totally worth it.

The big takeaway is don’t think too much about these – there are bigger fish to fry. 😉