Compounding is one of the hardest concepts to understand.

Human beings are not good at visualizing it because it’s extremely difficult to visualize logarithmic growth. A penny doubling every day for 30 days becomes more than $5.3 million. That seems impossible.

This is one reason why so few people invest their money in the stock market.

We think it’s gambling because it’s impossible to predict where the market will go in the short term. We also fail to recognize that the market goes up and the right in the long term. Both can be, and are, true.

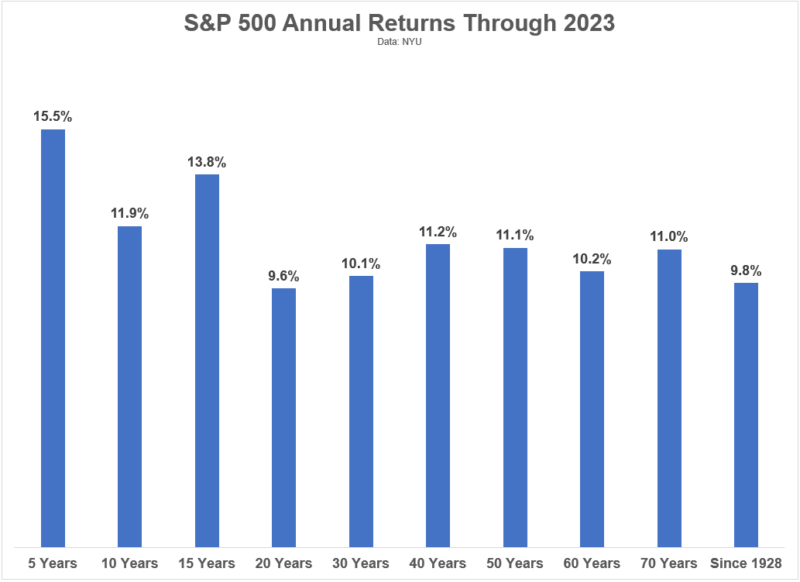

This chart from Ben Carlson’s A Wealth of Common Sense blog highlights this beautifully:

We are essentially the house in a game of blackjack. The odds are in our favor so we are more likely to win the longer we play the game. Time in the market trumps all else.

To convince ourselves to make the right decision, we have to simplify it. We have to make it an easy to understand tradeoff.

If you invest $100 today and it compounds at 8% a year for 30 years, it’ll be worth $1,006.27.

That’s the Rule of 10.

$100 invested today will be $1000 in thirty years.

We can debate the growth rate or perhaps the time period, but if you accept them at face value, then you’ll have $1,000.62 for every $100 you invest today.

Wait Jim, $1,000 doesn’t seem like a lot!

If the rule of 10 seems a little underwhelming… that’s because it is. Turning $100 into $1,000 would be great if it happened overnight. Or even within a year or two. If it takes 30 years, it sounds less exciting right?

But after another 10 years, the amount will double to $2,072.45.

And if you keep contributing, as you would in an investment portfolio, the portfolio will continue to grow at these accelerated paces. You aren’t saving $100 once. You’re going to have to do it over and over again.

This rule can help you understand tradeoffs between what you spend today and what you invest. It’s easier to conceptualize that you can spend $100 on another jacket today or spend an $1,000 in retirement.

No difficult calculations to remember, just multiple by ten.

But the power in investing isn’t in making one contribution and then stopping, right? What if you contribute $100 a month for 30 years and it compounds at 8% annually? You end up with $149,035.94 on $36,000 in contributions.

If you take it out to 40 years, the total is now $349,100.78 (on $48,000 of contributions).

That’s with just $100 a month.

Are you skeptical about the 8% rate or want a different time frame?

Here’s a simple table of how much $100 is worth after compounding for a certain number of years – make your own rule!

| Rate of Return | Years of Growth | Final Value |

|---|---|---|

| 10% | 30 | $1,744.94 |

| 10% | 20 | $672.75 |

| 10% | 10 | $259.37 |

| 8% | 30 | $1,006.27 |

| 8% | 20 | $466.10 |

| 8% | 10 | $215.89 |

| 6% | 30 | $574.35 |

| 6% | 20 | $320.71 |

| 6% | 10 | $179.08 |

You can use this investment calculator to do your own math and come up with your own rule. I use 8% and 30 years because it results in a nice number – 10X.

Whenever you’re deciding on a purchase, ask yourself… do you want it today or do you want 10 times that in retirement?

Sometimes it’ll be the purchase. Sometimes I’d rather keep the money and invest it.

Either way, now you’re making an accurate trade off.