Ownwell

Product Name: Ownwell

Product Description: Ownwell is a service that will protest your property tax assessment and attempt to get it lowered. They will also look for other discounts and programs that may lower your tax liability. They work on a “savings-or-free” model, which means you only pay them if they reduce your taxes.

About Ownwell

Ownwell was founded in 2020 with the goal of bringing sophisticated real estate tools to ordinary homeowners. They claim to save, on average, $1,430 annually and look to do 400,000-500,000 protests in 2024.

Pros

Easy to use

Free if not successful

Average annual savings of $1,430

Continuous monitoring for exemptions

Cons

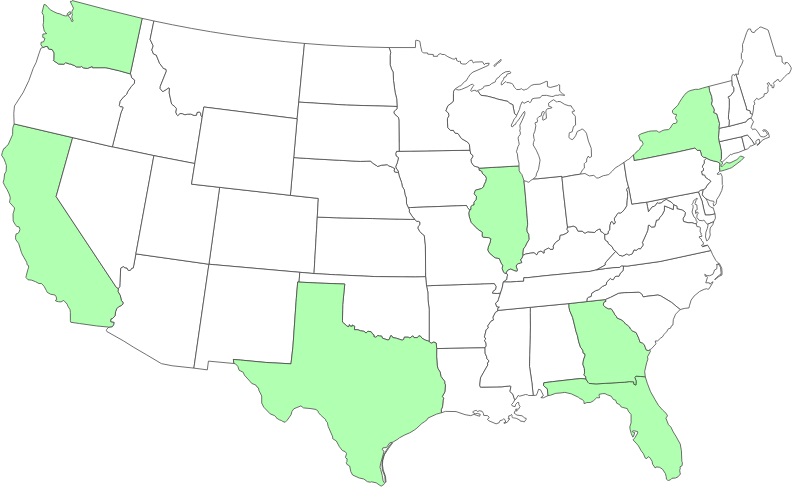

Only available in California, Florida, Georgia, Illinois, New York, Texas, and Washington

How much are your property taxes?

In our county in Maryland, we pay a total of $1.442 per $100 of assessed value.

1.442% doesn’t sound like a lot, but the median home price in my county is around $580,000.

That’s $8,400 a year.

When I received my property tax assessment last year, it included a significant increase in assessed value. We renovated a section of the house, so part of that was justified, but it seemed like the jump was too high.

I decided to contest my property taxes myself and won. The process, which you can read about in the linked article, took several hours spread across several weeks. And I was “lucky” in that I was given a good result at the first stage (just filling out a form), so I accepted it.

If they rejected my claim and required me to plead my case to a live panel, I’m not sure I’d be as comfortable doing that.

Fortunately, there are services out there that will do it for you.

One of those is called Ownwell.

At A Glance

- Ownwell will appeal your property taxes on your behalf

- Monitors for tax exemptions based on your individual property

- No upfront fees – pay only upon successful reduction of property taxes

- Pay 25% or 35% of savings, depending on your state

- Available in California, Florida, Georgia, Illinois, New York, Texas, and Washington. (but expanding all the time so check your state)

- Average savings is $1,148

Who Should Use Ownwell

Homeowners and Real Estate investors who want to ensure they aren’t overpaying their property taxes should consider Ownwell. They will appeal your property taxes for no upfront costs and you pay a percentage of your savings if your appeal is successful. So there is no risk and no leg work for you.

Table of Contents

Who Is Ownwell?

Ownwell is a service that will contest your property tax assessments with your taxing authority so you can pay less in property taxes. They will also find exemptions and other tax savings you may not know about or have overlooked.

Ownwell was founded by Colton Pace and Joseph Noor in 2020. Pace’s background in investing and asset management gave him exposure to the various tools used by real estate investors, and he wanted to bring them to regular homeowners. The result is Ownwell, a service to contest property taxes.

Ownwell doesn’t operate in every state (yet).

In Which States Does Ownwell Operate?

Ownwell isn’t in every state and for some of the states they do operate in, they aren’t in every single county.

As of April 2024, they are in California, Florida, Georgia, Illinois, New York, Texas, and Washington. You have to double check that your county is included (it’s not feasible to list every county here though, California has 58 counties and Texas as 254!).

They are adding counties all the time, so the best way to know is to go to Ownwell and enter your address.

When Can I Appeal My Property Taxes?

The schedule for when you can appeal will depend on your state and, in some cases, the county within that state. They’re all on different schedules.

For example, in Maryland, this process only happens once every three years. In New York, and many other states, it happens every single year!

I asked Ownwell to provide a schedule (and they did) but it’s a little complicated and hard to share on a single screen… also, many dates are county specific and they cover so many counties that it’s unwieldly to list it all here.

The end result is that the simplest thing to do is sign up for Ownwell and then wait for your assessment to arrive. Then, enter in the details and decide whether you should use them to contest your appraisal.

As there’s no cost to sign up, you can use their technology to help you manage the schedule and decide later if you want to use them.

How Does Ownwell Work?

First, go to Ownwell and enter your address.

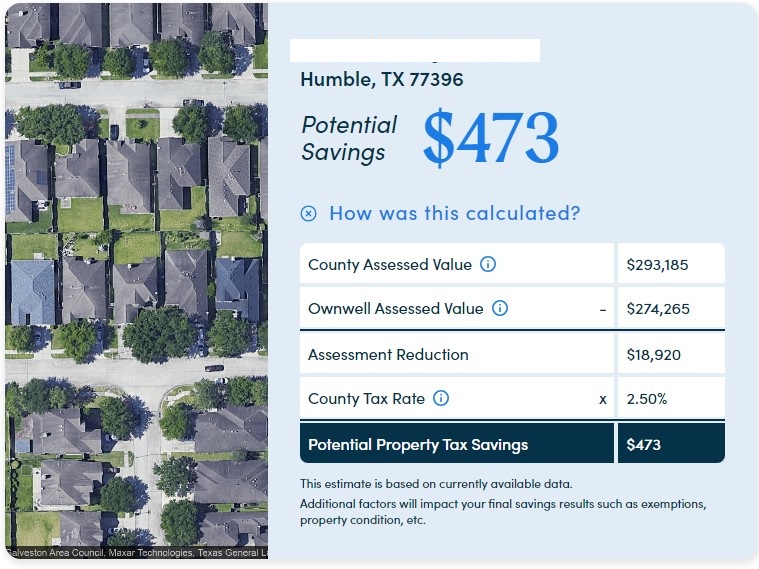

Since they don’t operate in Maryland, I chose a random property in Humble, TX (a suburb of Houston). They service Harris County.

It may not be worth it for a homeowner to learn the ins and outs of protesting property tax assessments for $473, especially if it’s not a guarantee you’ll get any reduction. But if I owned this home and didn’t want to do it, I’d be perfectly happy hiring someone on a contingency basis (I pay only if they win) – which is how Ownwell works (more on fees later).

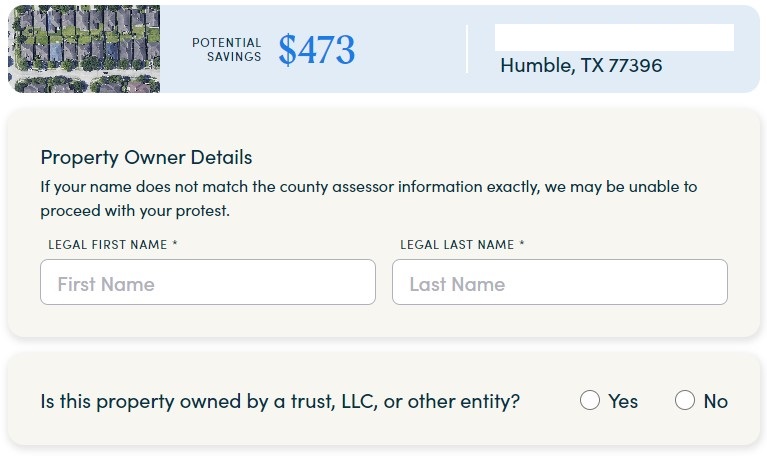

If you continue, you’ll be prompted to enter your information. (I’m using a demo account, if you do this yourself, enter your information)

The next few screens confirm information, like whether you purchased this property in the last 18 months and the property owner’s name.

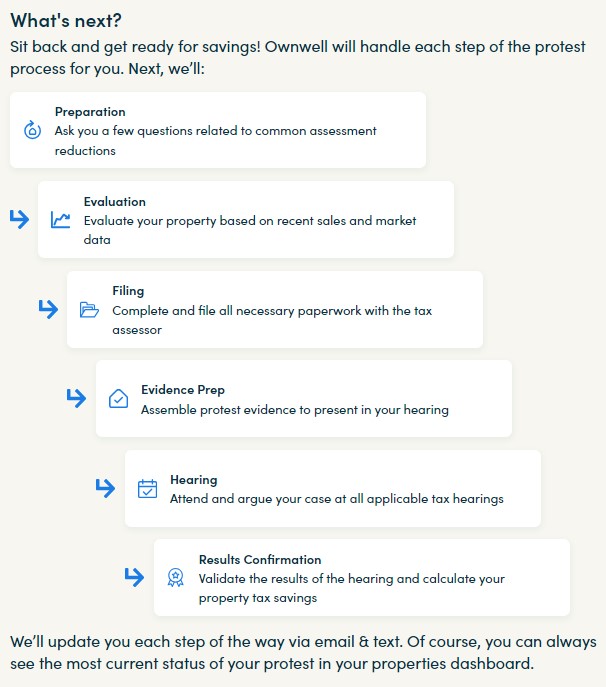

The last page, after you’ve confirmed all the details, authorizes Ownwell to act as your Tax Agent. This lets them contact the taxing authority on your behalf and contest your property taxes.

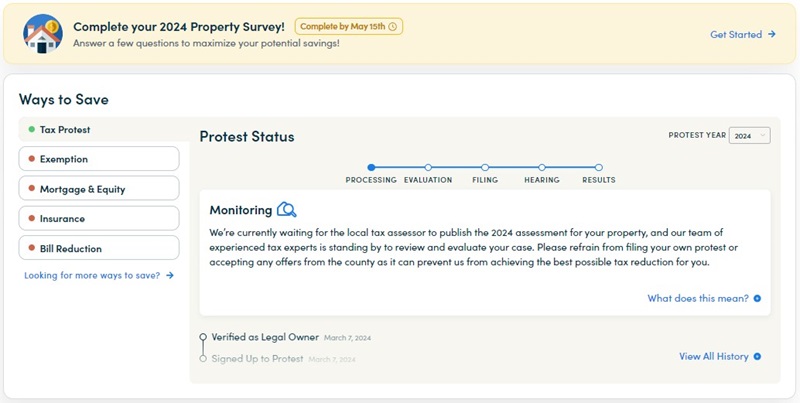

From here, you can log in and check the progress of your protest.

As of this writing, Texas hasn’t yet published the 2024 assessments, so Ownwell has nothing to do. I believe Texas publishes them in April, and then you have 30 days to protest.

This will vary from state to state and in Texas, you can do this every single year.

Finding Exemptions and Claiming Refunds

In addition to contesting your assessment this year, they offer a service to determine whether you’re eligible for any tax exemptions. If they find any, they can even make claims on previous years to get a tax refund.

There are a lot of different tax exemptions out there and these are challenging to keep track of. For example, here in Maryland, we have an Agricultural Use Assessment that significantly lowers property taxes on areas where you have agreed to keep to agricultural use. I only knew about it because the previous owner had it.

We don’t grow anything (commercial) on the land, it’s all wooded, but that counts. The only requirement is that we get an arborist to certify an agricultural use plan every few years, and we get a huge discount on the assessed value of the undeveloped land. It has saved us thousands of dollars a year.

Ownwell looks for exemptions like that.

Then, they will monitor your taxes each year to make sure everything is correct. If, for whatever reason, an exemption is left off, they’ll make sure to fix it.

Ownwell Fees

Ownwell operates on a success fee model – you only pay them if they win an appeal and lower your property taxes. They only charge you if your final property tax bill is reduced and they have a signed document from your taxing authority to prove it.

If they aren’t able to lower it, you pay nothing.

In California, New York, and Florida, the success fee is 35%. It is just 25% everywhere else.

For the above example, if Ownwell gets a $473 reduction in property taxes, I would pay them $118.25. I keep $354.75.

How does this fee compare to other companies? You should research this for your own state, as it will vary, but I found a tax firm in Texas that listed their pricing. On a single property, they charged 40% with a $149 minimum. For 2-5 properties, it was 35% with no minimum. Only 6+, it was 30%.

What are Ownwell Alternatives?

The biggest alternative is to call a local law firm that specializes in this same type of work. There are plenty of law firms that offer this. At this time, I’m not aware of a company that operates in multiple states.

The tradeoff with using a local law firm has to do with cost. They are typically not going to be able to work with individual homeowners and still be able to charge a small success fee. They often have minimum fees and will only take your case if they see it as being “worth their time.” In a quick search myself, I found that firms are very up front about this because contesting appraisals is time intensive and they don’t want to waste their time or yours.

As I mentioned in the above section about fees, I found a tax firm that charged 40% fee with a $149 minimum. In Texas, Ownwell charges just $25 with no minimum.

Alternatively, you can reach out to your real estate agent to see if they can help. This will be dependent on how friendly and available your agent is to this type of help. Some may do it for free, seeing it as a part of their offerings, while others won’t.

Is Ownwell Worth It?

It depends on how much you value your time and how much of a return you expect to get. If I owned a home in which a protest was going to net me $500 and it’s something I have to do every year, I’d more more likely to pay Ownwell a 25-35% success fee to handle it all for me. With four kids and a slew of other responsibilities, the ROI on my time just isn’t there.

Also, the property tax assessment process varies from state to state. In Maryland, we only have to do it once every three years and I had a personal interest in learning the process (also, I was happy after the first round reduction – the work gets considerably more involved after the first round). I realize I’m a weirdo like that, most people don’t care and just want to save money.

The only thing I do know is that you must contest your property tax assessment. You may not win a reduction, but you have to do it. Those increases will compound so you have to keep the increases as little as possible.

If you aren’t going to do it yourself, getting someone else to do it is better than taking the increase.

FAQs

Yes, Ownwell is a legitimate company that will appeal your property taxes for no upfront fee.

You absolutely can appeal your property taxes on your own. Assuming you have the time an inclination to research and file the appropriate documents. It took me a few hours of research, and I was successful in the first appeal.

Summary

Ownwell is a company that will appeal your property tax bill on your behalf with no upfront fees. You’ll pay either 25% or 35% (depending on your state) of the savings they can get you. If they are not successful at lowering your property tax bill, then their services are free.