Many investors rely on stock-picking services to help them choose the right investments for their portfolios, and The Motley Fool is one of the investment industry’s most popular stock-picking platforms.

The company was founded in 1993 by brothers Tom and David Gardner, who remain very active within the organization. But while the Motley Fool boasts over 1 million premium members, there are several other stock-picking services you can choose from.

In this article, I’ll give you a brief overview of The Motley Fool and share five alternatives for you to consider. Paying money for a premium stock-picking platform is an investment, so choosing the platform that best meets your needs is important.

Table of Contents

What Does Motley Fool Have to Offer?

The Motley Fool has become one of the most popular stock-picking services and a consistent provider of investment news and information.

The Motley Fool provides its members with access to new stock picks each month, detailed analysis of companies, model portfolios, advanced tools, and live streaming during market hours.

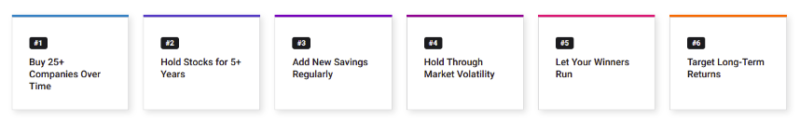

The Motley Fool investing philosophy looks like this:

Motley Fool Investment Plans

You can take advantage of The Motley Fool website, which provides a wealth of free information, including market commentary and individual stock recommendations. But the company also offers many premium services.

As The Motley Fool has grown, they’ve expanded beyond a single, targeted source of stock picks to dozens of plans across many investment niches.

Their offerings have become so numerous that they now have 42 different paid plans, each with its own objective and price structure. There are too many to list, but I’ve included five of the most popular packages in the following table:

| Plan | Objective | What You’ll Get | Price |

|---|---|---|---|

| Epic Bundle | Immediate access to MF’s four foundational stock-recommendation services: Stock Advisor, Rule Breakers, Everlasting Stocks, and Real Estate Winners | 6+ new stock recommendations each month+ 5 “Digital Asset Workshops.” | $499 per year |

| Stock Advisor | Market-beating stocks from MF’s award-winning service | Two new stock picks each month + 5 Best Buys Now + Starter Stocks + Community & investing resources | $199 per year |

| Rule Breakers | High-growth businesses MF thinks are poised to be tomorrow’s market leaders | Two new stock picks each month + 5 Best Buys Now + Starter Stocks + Community & investing resources | $299 per year |

| Everlasting Stocks | Tom Gardner’s new service with the same analyst team that has beaten the S&P 500 by 3X for the last 20 years | Immediate access to 15 stock recommendations from Tom’s holdings | $299 per year |

| Rule Your Retirement | Comprehensive retirement guidance | Model portfolios + Mutual fund & ETF recommendations + Social security tips, tricks, and strategies + Coverage and analysis on critical retirement topics | $149 per year |

Most of the plans offered by The Motley Fool are available on their website, while some require you to call in for more information. If you’re interested in a plan that requires you to call, be aware that The Motley Fool is known to engage in aggressive upselling. It’s possible you’ll call on one service and then be recommended to sign up for a higher-priced plan or one that adds multiple plans to the one you’ve selected. For more information, check out our full review of Motley Fool.

Learn more about Motley Fool Stock Advisor

Motley Fool Alternatives

As mentioned, The Motley Fool isn’t the only stock-picking service, far from it. Here are five Motley Fool alternatives you should consider before deciding on a platform.

Morningstar

Morningstar and The Motley Fool are similar in that they offer premium stock-picking services along with plenty of free content on their website. Morningstar is one of the most respected information sources in the investment industry, frequently quoted by popular investment websites and financial experts.

The company is perhaps best known for its investment ratings. They grade stocks and mutual funds on a five-point scale, with five points being the highest rating. Many investment companies rely on these ratings in making their own investment choices.

Like The Motley Fool, Morningstar offers several plans to help you up your investment game. This even includes a managed investment service for retirement plans.

But the centerpiece of the Morningstar organization is Morningstar Investor.

Morningstar Investor (formerly Morningstar Premium)

With Morningstar Investor, you can receive recommendations from more than 150 independent analysts and actionable analyses.

With each investment, you’ll get the following:

- Analyst Note

- Business Strategy and Outlook

- Economic Moat

- Fair Value and Profit Drivers

- Risk and Uncertainty

- Capital Allocation

- Security Rating (one through five stars)

- Security Screener

- Portfolio X-Ray (evaluate the asset allocation, sector weightings, fees and expenses, stocks stats and more of the holdings in your portfolio)

- Account Aggregation

- News and insights tailored to your portfolio

- Watchlists

Morningstar Investor starts with a seven-day free trial and is then available in a monthly subscription of $34.95, or $249 per year if you pay upfront. For more details, check out our full Morningstar Investor review.

Seeking Alpha

Seeking Alpha offers their website, which is another common source of investment news information throughout the industry, as well as their Basic plan, free of charge. The plan provides limited access to articles and rating tools and may be a good place to start for new investors.

Seeking Alpha Premium

Seeking Alpha Premium is designed to help you find better stocks and create your own Seeking Alpha portfolio. The plan comes with Editors’ Picks of specific stock picks, as well as Notable Calls & Insights to provide you with articles on big-picture investment developments.

You’ll also get access to Dividend Investing, ETFs & Portfolio Strategy, and regular tracking of various markets and market sectors.

Seeking Alpha Premium is available for $119 annually but starts with a seven-day free trial.

Seeking Alpha Pro

Seeking Alpha Pro is the company’s flagship program. It provides unlimited access to investing, analysis, four to six handpicked ideas sent daily, top ideas by Seeking Alpha experts, a curated list of short opportunities, the idea filter to pinpoint relevant articles, and VIP customer service.

Seeking Alpha Pro is offered at $499 per year or $69.99 per month. But either payment plan starts with 14 days free before your credit card is charged. Learn more in our Seeking Alpha review.

StockRover

StockRover is a pure investment research platform and stock-picking service. Unlike the other services on this list, it doesn’t function as an industry news and information source.

StockRover offers three different plans, Essentials, Premium, and Premium Plus. Pricing and service offerings for each plan are as follows:

Essentials – $7.99/month, $79.99/year, $139.99/2yr

- Over 8,500 North American stocks

- Plus 4,000 ETFs and 40,000 funds

- 260+ financial metrics

- 5 years of detailed financial history

- Powerful investment comparison

- Customizable views and columns

- Flexible stock screening

- Comprehensive charting capabilities

- Portfolio management

- Brokerage integration

- Watchlist tracking

- Real time text and email alerting

- The Stock Rover Investment Library

- Ad free experience

- Highly responsive support

Premium – $17.99/month, $179.99/year, $319.99/2yr

Everything in Essentials, Plus…

- 90+ additional metrics, 350+ in all

- 10 years of detailed financial history

- Data export

- Powerful Stock screening

- Ranked screening

- 100+ chartable financial metrics

- Advanced alerting

- Detailed portfolio analytics

- Future dividend income projections

- Monte Carlo portfolio simulation

- Correlation analysis

- Trade planning & rebalancing tools

- Multi-monitor support

- Integrated comment/notes facilities

- Prioritized email support

Premium Plus – $27.99/month, $279.99/year, $479.99/2yr

Everything in Premium, Plus…

- 300+ additional metrics, 650+ in all

- Custom Metrics

- Equation screening

- Historical data screening

- Powerful Stock and ETF screening

- 180+ ETF screening metrics

- Stock ratings

- Stock fair value & margin of safety

- Current and historical stock scoring

- Investor warnings

- Valuation charts

- Ratio charts

- Multiple metric charting

- Much higher data limits

- Top priority email support

You can also subscribe to StockRover’s Research Reports, which provide comprehensive investment reports on over 7,000 publicly traded companies. Each report is available for $99.99 per year. But if you bundle the reports with any yearly or two-year StockRover plan, the subscription fee drops to $49.99 per year.

Visit our StockRover review for more details.

Benzinga Pro

Benzinga is another respected news and information source in the financial world. Their Benzinga Pro service provides real-time stock trading news, trading signals, and intelligent chat rooms. It’s designed for active traders, including day and swing traders.

Benzinga Pro provides daily trading picks, exclusive market-moving stories, a stock scanner, stock alerts, and a mobile app. You can even take advantage of their stock audio to listen to stock information on the go.

Benzinga Pro is available at four different pricing levels, as well as the free version. Here’s a closer look at their plans:

Zacks

Like the other investment services on this list, Zacks has become a respected source of financial news and information. They also have a website where you can get plenty of free information, including stock, fund, and crypto analysis, earnings information, stock and fund screeners, a My Portfolio feature, and other research tools. It’s all available free of charge.

Zacks offers no fewer than 27 paid service plans. The most popular are Ultimate, Investor Collection, and Zacks Premium.

Zacks Ultimate

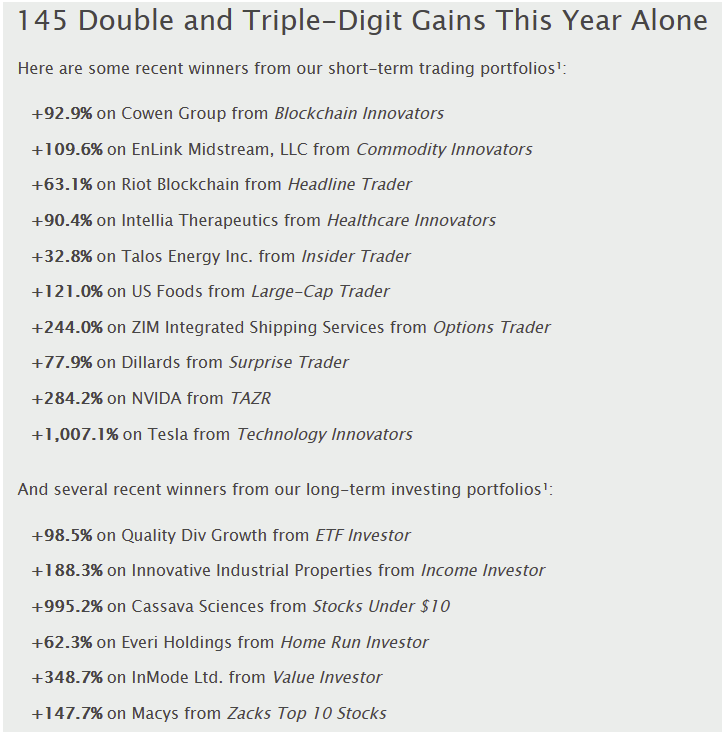

With Ultimate, you get full access to Zacks’ private trades. That includes their short-term trading portfolios and long-term investment portfolios. It also comes with the Inside Trader and Surprise Trader newsletters.

Zacks makes the following claims about the success of their stock picks:

Zacks Ultimate is available for $495 per year or $59 per month. But it starts with full 30-day access for just $1 to allow you to check out the service.

Zacks Investor Collection

According to Zacks, their Investor Collection gives you “access to their best stocks for the long term.” They provide all buys and sells from their long-term portfolios. That includes real-time buy and sell signals and all of Zacks premium research tools and reports that help you find your winning investments.

You’ll receive email alerts for other Zacks services, including Stocks Under $10, Home Run Investor, Value Investor, ETF Investor, Income Investor, Zacks Top 10 Stocks, Zacks Premium (below), and Zacks Confidential.

Zacks Investor Collection is available for $59 per month or $495 per year but also starts with full 30 days of access for just $1.

Zacks Premium

Zacks Premium provides powerful tools and research to help improve your portfolio performance. The plan includes Zacks Rank #1 stock list, Zacks Focus List of the 50 top long-term stocks, the Industry Rank of the best stocks in the best industries, and Zacks Earnings ESP Filter, identifying the stocks with the highest probability of positive earnings surprises. You’ll also have access to Equity Research Reports and Zacks Premium Screener.

Zacks Premium is available at an annual subscription price of $249 but is free for the first 30 days. Our Zacks review has more information.

The Motley Fool vs. The Competition: Which Should You Choose?

Stock-picking services are not for everyone. They’re designed specifically for self-directed investors who manage their own portfolios and are primarily interested in identifying potentially winning investment securities. If you are a passive investor, preferring to invest in index funds on a buy-and-hold basis, you probably do not need any of these services.

However, if you are a self-directed investor, and are unsure which stock-picking service to choose based on this analysis or any other, take advantage of the free trial offers available with each.

That will allow you to test the service, identify a few attractive stock picks, and determine which platform you like the best.

Otherwise, choose the service that best matches your investment style and personal preferences. The subscription fee may also be a factor, depending on your portfolio size. For example, a $300 per year subscription fee might make sense if you have a $50,000 portfolio. But a $3,000 annual fee, which would represent 6% of your portfolio value, is excessive.

Whatever plan you choose, do so wisely. Stock picking is at the heart of investing success, at least if you’re an active trader. It’ll determine your success or failure in managing your portfolio in the years and decades ahead.

Your future financial success may depend on the choices you make right now.