MaxMyInterest

Strengths

- Earn competitive interest rates from multiple high-yield savings accounts

- Access higher FDIC insurance limits

- Automatically optimizes high-yield savings balances

- Customizable transfer rules and balance limits

- No minimum balance requirements

Weaknesses

- 0.04% quarterly membership fee ($20 minimum per quarter)

- Must open a Max Checking account to link to most bank accounts

- Is a third-party banking app instead of an actual bank

- Can take several days for transfers to process

Earning the highest possible interest rate on your savings can feel like playing a game of Whac-A-Mole if you’re constantly transferring funds to chase higher yields. But MaxMyInterest can help you find more productive ways to spend your time.

The platform partners with several online banks so you can access multiple savings accounts with the highest APYs while maintaining FDIC coverage. Max looks for the highest APYs being offered and can shift your funds monthly on your behalf.

Our MaxMyInterest review looks at how this online banking service works and if the convenience is worth the cost.

Table of Contents

What Is MaxMyInterest?

MaxMyInterest is a fintech platform that individual investors can use to find the best high-yield savings account interest rates. Each month, MaxMyInterest will provide you with the optimal allocation for your savings balances to help you earn the highest APYs. It will then automatically send your transfer instructions to your banks so you can get the highest possible rates. There is a fee involved, which we’ll cover later.

It’s a convenient way to take advantage of the recent surge in interest rates, which has enabled investors to earn an attractive return on short-term investments while avoiding the volatility of stocks and bonds.

MaxMyInterest was launched initially by Six Trees Capital in 2013 as a cash management service for high-net-worth individuals. It’s now open to the general public without an account minimum. However, there is a minimum $20 service fee per quarter, so it’s best to deposit at least $50,000.

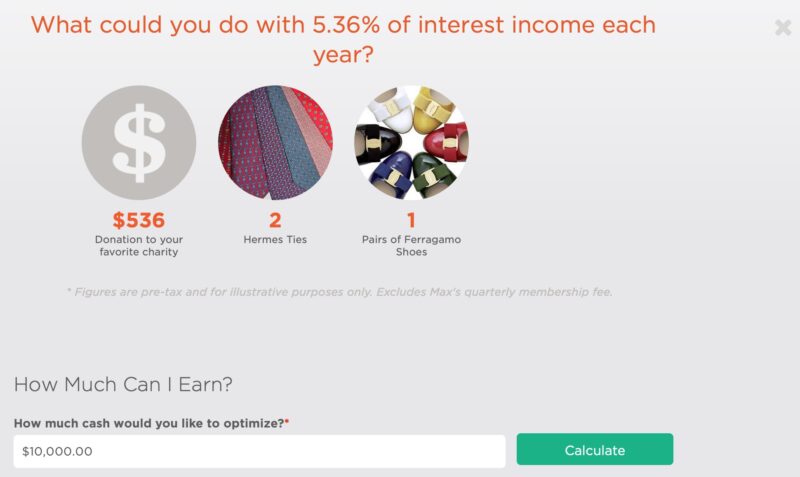

At the time of this writing, Max members can earn up to 5.36% APY on deposits, while many competing high-yield savings accounts yield 4.60% or less. The yield is substantially higher than the national average savings account rate of 0.60%. All numbers are current for January 3, 2023.

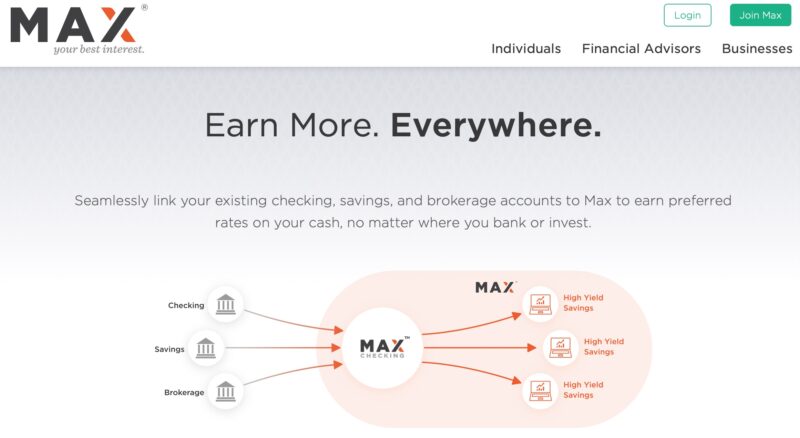

You can link your existing banking and brokerage accounts from over 18 financial institutions. It’s also possible to open a Max Checking account to consolidate your balances and gain easier access to your cash reserves.

Learn More About MaxMyInterest

MaxMyInterest Fees

A 0.04% quarterly membership fee applies to all balances, which equates to $40 per $100,000 in assets. As each account is subject to a $20 minimum fee every three months, your balance needs to be at least $50,000 to achieve 0.04%.

If you’re willing to put in the extra work, you can earn similar yields by manually transferring funds between banks that don’t charge monthly service fees. But in our opinion, MaxMyInterest’s fee is a small price to pay with interest rates at their highest levels in a generation and still earn compound interest.

There are no additional service fees, although you will receive a 1099-INT tax form after earning at least $10 in annual interest. While your funds will likely be held at several partner banks, you only receive one year-end tax form, which streamlines the tax prep process.

A third optional fee is for wire transfers for same-day withdrawals instead of waiting several business days for the funds to deposit into your linked checking or brokerage account.

Who Should Use MaxMyInterest?

Consider using MaxMyInterest when you don’t want to self-manage your savings deposits to find the best rates. This service makes it easy to earn interest from the best high-interest savings account without losing sleep about an underperforming savings account.

Individuals and businesses can open accounts to boost their interest income effortlessly. However, you must be comfortable using a third-party app that’s not actually a bank to help you save money. Don’t worry; MaxMyInterest partners with FDIC-insured banks to save your money and earn interest. These rates are available to the general public in many situations.

While there are no minimum balance requirements, the 0.04% quarterly service fee and $20 minimum per three months are deterrents for accounts smaller than $50,000. This fee is also a headache for yield-chasers who are comfortable dedicating several minutes each month to transfer funds to the best savings account interest rate manually.

Related Post: Are banks offering 7% savings accounts now?

Learn More About MaxMyInterest

How MaxMyInterest Works

The following MaxMyInterest features can help you start earning more interest on your hard-earned money.

Max Checking Account

First, you will link your main bank accounts and brokerage accounts to calculate your cash reserves and initiate a transfer. Most people are better off opening a Max Checking account as it links to just about any checking, savings, or brokerage account through a service link Plaid. You can link multiple external accounts while the sweep feature only connects one account.

You can create an individual or joint account. There are no additional fees to open a Max Checking account, which includes the following benefits:

This account is FDIC-insured and managed by Customers Bank (Member FDIC #34444).

If you maintain a minimum $10,000 balance, you’ll earn a $25 quarterly rebate (up to $100 per year) on your Max membership fee. A balance exceeding $20,000 triggers a $50 quarterly rebate (up to $200 per year). You can crunch the numbers and evaluate the opportunity cost versus keeping this balance in a high-yield savings account.

Max Sweep Account

It’s also possible to link one external account with the Max Sweep feature. You may prefer this option to avoid opening another banking account, although you won’t qualify for the fee rebate.

MaxMyInterest links to banking and brokerage accounts from over 18 financial institutions:

- Bank of America

- J.P. Morgan/Chase Bank

- Capital One

- Charles Schwab Bank

- Citibank

- City National Bank

- E*Trade Bank

- Fidelity CMA

- Fifth Third Bank

- First Republic Bank

- Huntington Bank

- PNC Bank

- TD Bank

- Truist Bank

- USAA Bank

- US Bank

- Wells Fargo

- Zions Bank

As you can see, most national banks make the list. This can save you from setting up another bank account which can require adjusting your direct deposit details and other overlooked actions.

Monthly Optimizations

Once you’ve linked your accounts, Max evaluates your current account balance and sets up a high-interest savings strategy. You can establish a target balance to avoid having your spending account balance dip below a specific amount.

By default, MaxMyInterest evaluates interest rates once a month and suggests an optimization plan. You get to choose which day the assessment occurs, establish customized rules to safeguard your balance and choose which external account to fund your new deposits from.

In this way, MaxMyInterest is similar to an investment robo-advisor, but it specializes in high-interest FDIC-insured savings accounts instead of investment funds.

Intelligent Funds Transfers

MaxMyInterest’s Intelligent Funds Transfer℠ feature lets you set up fund transfers in between the scheduled monthly optimizations. Max suggests which accounts to pull from to optimize your yield while maintaining a healthy cash cushion in your linked accounts.

All transfers are done via ACH to avoid bank nuisance fees, although it can take 2-3 days for your funds to become accessible.

FDIC Insurance

Individuals can qualify for up to $2 million in additional FDIC coverage, and couples can qualify for up to $8 million. The standard FDIC insurance limit is $250,000 per bank partner, but you can be eligible for more by spreading your assets across multiple institutions.

The MaxMyInterest-supported online savings accounts include:

Interest rates vary for each institution and can change at any time. The auto-optimization ensures you receive the best yield with your FDIC-insured assets.

Learn More About MaxMyInterest

MaxMyInterest Pros and Cons

There are definite pros and cons to using MaxMyInterest to pursue higher bank rates. Here’s the list we came up with:

Pros

- Earn competitive interest rates from multiple high-yield savings accounts

- Access higher FDIC insurance limits

- Automatically optimizes your high-yield savings balances

- Customizable transfer rules and balance limits

- No minimum balance requirements

Cons

- 0.04% quarterly membership fee ($20 minimum per quarter)

- Must open a Max Checking account to link to most bank accounts

- It is a third-party fintech app and not an actual bank

- It can take several days for transfers to process

MaxMyInterest Alternatives

You can earn similar yields by leveraging one or more MaxMyInterest alternatives. in fact, the following high-interest savings platforms may offer more appealing account options or charge fewer fees.

Raisin

Raisin (formerly SaveBetter) partners with federally insured banks and credit unions to offer high-yield savings accounts, term CDs, and no-penalty CDs.

There are no service fees, and the deposits minimum are as low as $1. Similar to MaxMyInterest, this is a third-party app with many bank partners, so you receive a consolidated 1099-INT tax form to display all of your interest income on one piece of paper. Read our Raisin review for more information.

MySavingsDirect

MySavingsDirect offers a high-yield interest savings account, competitive CD rates, and precious metals storage. There are zero minimum balance requirements for the online savings account, and you can enjoy other perks that brick-and-mortar banks tend to skimp on.

Read our MySavingsDirect review for more.

Learn More About MySavingsDirect

Bank Account Bonuses

Since you’re most likely moving money monthly to earn the most interest, you may want to consider bank account signup bonuses. Just make sure you meet the offer requirements, which typically include receiving qualifying direct deposits or maintaining a minimum balance of new money.

Also, check out these bank bonuses that don’t require a direct deposit.

FAQs

MaxMyInterest is a third-party financial app that partners with FDIC-insured banks offering some of the highest savings account rates. Working with a go-between adds a layer of complexity, but your accounts link securely, and the partner banks hold your assets.

There is a potential risk of bank failure, but the app makes it easy to earn the most interest with a managed portfolio.

Online and email support is available for members. On-demand phone support isn’t available like a big bank offers, although contacting the holding bank for account-specific inquiries is possible.

Yes, there is a dedicated platform for financial advisors to offer MaxMyInterest to their clients. Additionally, individual and joint accounts can add their financial advisor’s name and email address to their profile page to grant read-only access.

Learn More About MaxMyInterest

The Bottom Line on MaxMyInterest

MaxMyInterest makes earning a competitive high-yield savings rate easier as the platform has many bank partners and can optimize your account once a month or more frequently. Customizable rules and banking features make it easy to manage your Max and external account balances. Unfortunately, the quarterly service fees are expensive for small account balances and may encourage savers to self-manage their savings to earn a similar interest rate.