This year’s federal tax deadline is Tuesday, April 18, 2023. If you cannot get your tax return together before this date, you can file a tax extension request to avoid late filing penalties (although your tax dollars are still due by this date).

For example, you might be navigating a precarious life event, living overseas, or waiting for those final year-end tax documents such as a Schedule K-1 or a corrected Form 1099. Life happens, but the tax collector still wants their fair share.

Knowing how to get a tax extension online can relieve stress if you owe income taxes this year.

Thankfully, the tax extension process is relatively simple, although there are a few things to know in order to avoid tax penalties and interest.

Table of Contents

What Is a Tax Extension?

A tax extension is a six-month grace period to finalize your tax return without late filing penalties. Individuals and businesses can submit a tax extension form online or by mail.

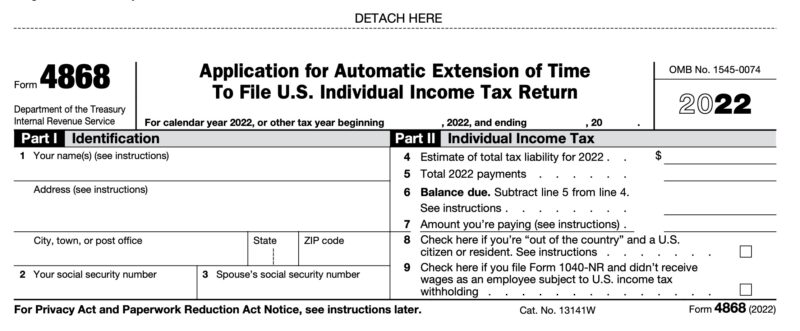

Individuals who submit IRS Form 4868 before the extension deadline won’t pay a Failure to File penalty, which is 5% of their unpaid monthly taxes (up to a maximum of 25% after five months of not filing).

However, you must still pay your estimated income tax due on or before the federal tax deadline to avoid late penalties and interest on your tax liability.

Fortunately, paying 90% of your taxes due will waive any late penalties and interest when you submit the remaining amount due with your return.

Tax Extension Filing Deadlines

There are two important dates to remember if you need more time to file your taxes:

- April 18, 2023: You must submit your tax extension request before the federal IRS tax deadline. Typically, the IRS tax deadline is April 15th although it falls on April 18, 2023, this year due to the 15th landing on a Saturday and the District of Columbia’s Emancipation Day being on Monday the 17th.

- October 16, 2023: You have until this date to submit your tax return to avoid a Failure to File penalty. As an FYI, the usual extension deadline is October 15th, but it falls on a Sunday this year. The IRS moves it to the next business day when the 15th is on a Saturday, Sunday, or a legal holiday.

This year’s tax extension deadlines are unique, as the standard tax filing deadlines are on the weekend this year. Therefore, you have a further reprieve until the next business day.

Learn More: What happens if I don’t file my taxes?

Do I Need to File a Tax Extension?

You must file a tax extension if you anticipate owing income taxes but don’t have all the necessary details and forms to submit an accurate tax return before the deadline.

However, filing an extension is unnecessary if you get a tax refund, as you won’t owe the IRS money. But there’s nothing wrong with submitting a form as a safeguard just in case you receive an unexpected tax bill.

Tax Extension Exemptions

The following taxpayers can be excused from submitting a tax extension before the mid-April deadline:

- Disaster victims: The IRS maintains a list of disaster-related tax relief, including delayed filing deadlines. For example, filers in select states may have until May 15.

- Combat zone service: Members of the U.S. Armed Forces and eligible civilians in combat areas are exempt from the standard filing and extension timelines. You can get the specific details from IRS Publication 3.

- Living overseas: Military households and civilians living or working outside the United States or Puerto Rico can be eligible for an automatic 2-month extension. However, you must attach a statement to your return to state your reason. The form is unnecessary if you don’t need to file a tax return.

As a reminder, a tax extension waives the failure to file a penalty, but you’re still responsible for paying your income tax due. The extension form has a box to estimate your income tax owed, so you can submit payment if required.

How to File for an IRS Tax Extension Online

Here is a step-by-step look at how you can submit your tax extension electronically.

Complete IRS Form 4868

Individual taxpayers will complete Form 4868, although there’s a different form for business or corporate income tax returns.

Form 4868 is short and simple to complete, although you should complete as much of your return as possible to estimate your tax liability. That means calculating your adjusted gross income, tax deductions, and tax credits to the best of your ability.

Thankfully, you can receive help to file for an extension:

- IRS Free File: The IRS Free File Program lets households with an adjusted gross income (AGI) below $73,000 prepare their taxes with guided help at no cost. This program also offers free fillable forms for all federal income tax brackets.

- Online tax software: The best tax software programs, such as TurboTax and H&R Block, can effortlessly generate this form.

- Tax preparer: If you hire a local Enrolled Agent (EA) or a Certified Public Accountant (CPA) to prepare your tax return, they can complete this form as well.

Any of the above methods can help you prepare your return during tax season, file for an extension, pay your estimated taxes, and finalize your return during the six-month extension period.

Submitting your extension online is usually the quickest and easiest method. You can anticipate receiving a confirmation email within 24 hours so you know your request is approved, providing additional peace of mind.

After submitting the extension, you have until October 16, 2023, to file your return.

An Exception to the Rule

One group of taxpayers that must mail in their tax extension forms are those who pay by the fiscal year. Nearly every household follows the calendar year schedule (January 1 to December 31), so this restriction is a non-issue but is worth mentioning.

If you decide to mail in your extension, the IRS form lists the mailing address for your state. As a forewarning, there is a separate address if you will be sending payment versus just the form.

Pay Your Estimated Tax Amount

You must pay at least 90% of your final liability before the federal tax deadline to avoid the late payment penalty.

The extension form asks you to subtract your total tax payments (so far) from your estimated total tax liability. Any estimated taxes, employer tax withholdings, and job bonus taxes offset the remaining amount due and count toward the 90% requirement.

For example, if your final tax liability is $9,000, you must pay at least $8,100 by the federal tax filing deadline to avoid late payment penalties and interest. The penalty is 0.5% of the tax owed on April 18, 2023, and has a maximum penalty of 25%.

File Tax Return

Once you have all of your affairs in order, you can finalize your Form 1040 and send it to the IRS before the October filing deadline.

If you paid at least 90% of your taxes due before the standard deadline, your remaining balance is due with your return to avoid penalties and interest.

State Income Tax Extensions

Most states with an income tax will grant a six-month extension upon request for similar reasons as getting a federal tax extension. Check with your state tax agency, tax prep software, or tax preparer to complete the specific form and find out your new tax return due date.

Tax Extension FAQs

No, any person needing to file a tax return can request an extension for free. However, it’s important to remember that a tax extension only waives the late filing penalty, but the necessary income taxes are still due by the standard tax filing deadline.

It’s free to file a tax extension request, although your tax software or tax preparer. However, you may need to pay for a third party to prepare your return on your behalf if you don’t qualify for a free tax service.

Unfortunately, the IRS only grants one six-month tax extension. Your tax return is subject to a late filing penalty if the October tax extension deadline is missed.

It’s better to request an IRS tax extension online as the processing speeds are faster and you can easily track the progress of your request. In most cases, online filers will receive a confirmation email within 24 hours of sending their request online.

You will need to provide these basic details to file a tax extension:

– Legal name

– Home address

– Social Security number (joint returns need their spouse’s SSN too)

– Estimated income tax liability

While you don’t need to provide a reason for needing an extension, out-of-country residents will need to provide an additional statement to process their request.

Final Thoughts

Tax filing season cannot end soon enough for most of us, so you can determine if you owe taxes or get a refund and can start achieving your other financial priorities. Sometimes, you need a little extra time to file your taxes, and a tax extension provides breathing room.

Getting a tax extension online is easy, but you should pay attention to the deadlines to avoid additional penalties and interest.