Could you fit the basics of personal finance onto a single index card?

Over ten years ago, Harold Pollack interviewed Helaine Olen and famously said that the best financial advice for most people could fit onto an index card. Pollack is a professor at the University of Chicago, and while he is most well-known for his views on public policy, the index card is one of his most well-known creations.

I was curious: How does it look after ten years?

Does it still fit in a world where people shell thousands on an NFT or cryptocurrency?

What about when interest rates are the highest it has been in decades?

Table of Contents

- What is on the Index Card?

- 1. Max your 401(k) or equivalent employee contribution.

- 2. Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds.

- 3. Never buy or sell an individual security.

- 4. Save 20% of your money.

- 5. Pay your credit card balance in full every month.

- 6. Maximize tax-advantaged savings vehicles like Roth, SEP and 529 accounts.

- 7. Pay attention to fees. Avoid actively managed funds.

- 8. Make financial advisors commit to the fiduciary standard.

- 9. Promote social insurance programs to help people when things go wrong.

- What does the Index Card Do Well?

- What is the Index Card Missing?

What is on the Index Card?

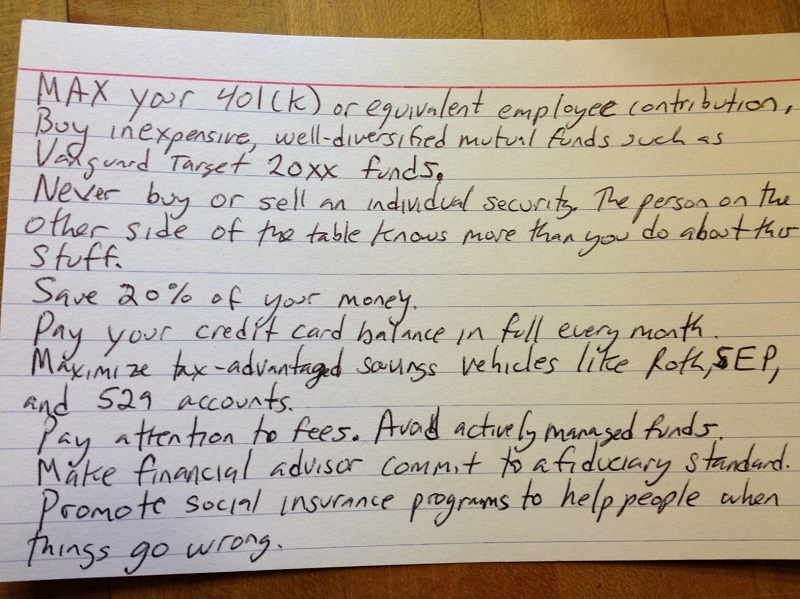

First, the 9 pillars of personal finances are written on the index card itself.

- Max your 401(k) or equivalent employee contribution.

- Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds.

- Never buy or sell an individual security. The person on the other side of the table knows more than you do about this stuff.

- Save 20% of your money.

- Pay your credit card balance in full every month.

- Maximize tax-advantaged savings vehicles like Roth, SEP, and 529 accounts.

- Pay attention to fees. Avoid actively managed funds.

- Make financial advisors commit to the fiduciary standard.

- Promote social insurance programs to help people when things go wrong.

Before we dig too deep into the criticism, I want to acknowledge that this appears to be a list of general rules of thumb that should give you guidance on what’s best. It’s not an all-inclusive strategy.

For example, the most important step anyone can take is to come up with a financial plan. You don’t need to go to a financial planner to create it, but you do need to have an idea of what you wish to accomplish and by when.

Also, Pollack went on to write a book with Olen about this card (The Index Card: Why Personal Finance Doesn’t Have to Be Complicated), and only in something of that length can you get into the nuance of each line.

1. Max your 401(k) or equivalent employee contribution.

Tax-deferred retirement accounts are fantastic investing vehicles and as long as it fits your long-term plans, you want to contribute as much as you can, as early as you can. By contributing early, you allow the power of compounding to take hold.

I don’t believe you need to try to hit the 401(k)’s annual contribution limit if you have competing savings goals. As long as you’re maximizing what you can contribute, you’re well on your way.

This pairs with its close cousin, #6 Maximize tax-advantaged savings vehicles like Roth, SEP, and 529 accounts, because you want to take advantage of both because of the tax benefits.

2. Buy inexpensive, well-diversified mutual funds such as Vanguard Target 20xx funds.

Vanguard has made a trillion-dollar business out of selling inexpensive, well-diversified mutual and index funds. Their Target Retirement funds are simply a collection of those funds. Over time, as the target date nears, the allocation changes to fit the target age.

There’s no reason you need to buy an expensive, non-well-diversified mutual fund so this advice is pretty safe to follow. 🤣

That said, there are expensive mutual funds and they exist because:

- Those investors did not have any other options

- Those investors were unaware alternatives exist

For example, take a look at Putnam BDC Income ETF (PBDC). It’s an exchange-traded fund that invests “in companies offering attractive income to public investors through private market exposure.” It has a total annual fund operating expenses of 10.61%!

I’m not throwing any shade at this ETF. There is some investor out there who would benefit from owning this ETF but most do not. It’s a niche ETF with very high fees, the opposite of this sage advice.

You are better off going with a target date fund or even a simple three-fund portfolio.

3. Never buy or sell an individual security.

The person on the other side of the table knows more than you do about this stuff.

You can be a very successful investor by just investing in ETFs and mutual funds. You can get market returns, enjoy your life, and never buy an individual security.

That said, I dislike the notion that you shouldn’t do this because other “person” knows more than you about this stuff. I’d add nuance to say that there’s no person on the other side of the table, it’s the market and the market doesn’t know anything. The market is the consensus of every participant and it’s also irrational.

But lacking knowledge or expertise isn’t a good reason to avoid doing something. If you care enough, you should try to learn more and gain knowledge. You may still come to the conclusion that you don’t need to buy an individual security.

You also need to avoid the Dunning-Kruger effect when you learn a little bit and overestimate your expertise. There are a lot of investors who benefited from Tesla’s run and now feel they are great stock pickers!

(Finally, this includes all kinds of securities like bitcoin, dogecoin, NFTs, etc… you don’t need those to prosper!)

4. Save 20% of your money.

Yes, we could amend it to say “Save at least 20% of your money.”

You could also add that this can include what you pay down towards existing high-interest debt. If you have credit card debt, you want to be reducing that as much as possible. Saving 20% into a savings account while paying double-digit credit card interest is counterproductive.

While you’re at it, don’t pay more than 30% for housing. (Money ratios are very useful reminders!)

5. Pay your credit card balance in full every month.

100% solid gold advice. There’s no reason to carry a balance unless you have no other choice.

Some people believe that you need to carry a balance to build up credit, but that’s not true. Your credit card reports your statement balance whenever it closes for the month. If you pay it down to $0 (always!), the company still reports the balance to the bureaus so you get “credit” for usage and good behavior.

Some experts suggest you pay it off early so the amount reported is lower, thus lowering your credit utilization. That’s good advice too, though it’s unclear how much of a benefit there is and for how long.

When you carry a credit card balance from month to month, you lose the grace period. If you start each cycle with a $0 balance, you don’t pay interest on your purchases that month. That’s the grace period. If you carry a balance, there’s no grace period. Interest accrues immediately.

6. Maximize tax-advantaged savings vehicles like Roth, SEP and 529 accounts.

Taxes are one of the largest expenses you’ll pay each year and if you can reduce it in some way, fantastic!

If you are eligible for a Roth IRA, I would recommend contributing as much as you can. The amount you can contribute is based on your modified adjusted gross income. If you earn too much, you can’t contribute as much. The contribution limit for a Roth IRA in 2023 is $6,500 and the income phase-out goes from $138,000 – $153,000 (single filers).

As for the 529, the rules are changing as a result of the SECURE 2.0 Act and the 529 is more flexible than before. The areas you can use the 529 will expand to include K-12 expenses and you can even rollover some of it to a Roth IRA. The 529 is even better than when Pollack first suggested it in this line.

7. Pay attention to fees. Avoid actively managed funds.

If you followed #2, investing with target date retirement funds or just low-cost mutual funds, then this one is redundant when it comes to investment options.

That said, “Pay attention to fees” is sound advice all around. Actively managed funds are generally bad but you need to pay attention to other fees too. If you work with a financial advisor, do you pay them for their time or do you pay a percentage of assets under management? (you only need fee only advisors!!!)

Are they paid a commission for the products and services they recommend?

Follow the money.

8. Make financial advisors commit to the fiduciary standard.

A fiduciary standard is when the advisor must put your interests above their own.

There’s also a weaker standard known as a suitability standard, which means the advice must be suitable for your needs.

Investment advisors must follow a fiduciary standard, whereas a broker only needs to fit a suitability standard.

If you’re going to work with an advisor, confirm they are a fiduciary before moving forward. Great advice here.

9. Promote social insurance programs to help people when things go wrong.

This is good advice but should be expanded to ensure that you are personally insured for all the liabilities in life.

If you own a home, make sure you have homeowners and flood insurance (if you have a mortgage, the lender will require this). If you own a car, make sure you have adequate auto insurance (states all require this). If you have a body, you need health insurance, dental, and vision.

If you have other debts or financial responsibilities, such as children, then you’ll want to make sure you have adequate life insurance. This way, in the event of your death, they are taken care of.

Finally, it may be wise to get umbrella insurance to cover everything else.

What does the Index Card Do Well?

Overall, I think the index card is great. It contains a lot of basic personal finance advice that everyone should be following.

The basics are easy but sometimes we need a reminder. The day to day can be overwhelming, especially if you work a demanding job, and so it’s easy to forget the basics.

The index card works best for people who are in the first quarter of their personal finance development. This isn’t based on age, just on your education and awareness of personal finance concepts. If you are new to managing your money, the index card is a good first step.

It’s important to note that the card was meant to capture the basics that apply to as many people as possible. On that mission, it has delivered. But the risk is that the card is too basic. We know we should save more, we shouldn’t carry credit card debt, and we should invest in low-cost mutual funds.

The card also identifies a few dark corners of the financial world that you should avoid. A target date fund is great, individual securities are largely unnecessary, and you want a fiduciary. It’s easy to go down the rabbit hole of investment products when you can stick with the basics, get a lot of the benefit of investing, and live the rest of your life.

If you follow everything it says, you’ll be in good shape, but it’s not all-encompassing and you still need to do a little extra homework.

Now that we’ve handed out the roses, what are the thorns?

What is the Index Card Missing?

The biggest miss is that it doesn’t talk about your financial plan. What are your goals? When do you want to achieve them? Should you adjust those goals and the schedule based on your means? If this card is a list of tactics, having an overall strategy (in a financial plan) would help inform many of the decisions you make with your money.

You don’t have to work with a financial advisor to come up with a financial plan, but one can help. You can start by building your own financial plan and then bring it to someone who can give it a look. Armed with a plan, you can determine how much you should be saving to the various tax advantaged accounts. You don’t want to save too much only to have to pull it out to fund a need.

Next, it doesn’t really touch on anything for families, retirees, or anyone else who may have passed through a few of life’s major milestones. It doesn’t have much advice for people who are about to retire or about to buy a home. I get that those may be too specific to fit on a single card, so I don’t fault the card for not including them.

It is missing anything notable about insurance and how to be adequately protected. We touched on it in our critique of #9, which was about promoting social programs. It also doesn’t include anything about charitable giving too, though I suppose that could also fall into #9’s bucket.

Finally, we don’t have any mention of estate planning, which I believe is important, especially as you get older. Estate planning and end of life planning can be uncomfortable to think about but if you don’t do it, your family is forced to guess at what you want.

I view the index card as a good reminder of good personal finance hygiene, like brushing your teeth in the morning and flossing every night. It’s never bad to review the basics but just know it’s not

What do you think of the index card? What does it get right? What may it be missing?