Founded in 2021, CD Valet is a searchable database of certificate of deposit rates created by John Blizzard through Seattle Bank, where he has been President and CEO since April of 2014.

Though it was created through a single bank, it lists over 30,000 CD rates across the country.

CD Valet’s strength is that it lists CDs across the country, allows you to search by state and bank name, and can filter based on minimum term (<6 months to 60 months) and maximum term lengths, APY, and amount. They cover commercial banks as well as credit unions.

They will surface rates you are unlikely to find yourself. For example, did you know that the Lynchburg Municipal Employees FCU has a 78-month CD with a 6.50% APY? (as of 1/13/2026)

Probably not. It’s a 65th anniversary special but membership is limited to folks who live or work in Lynchburg, VA.

You might say to yourself – “who cares about an awesome CD if I can’t get it?”

Right now, there are plenty of folks in Lynchburg who don’t know about this CD. This may be the case for you too.

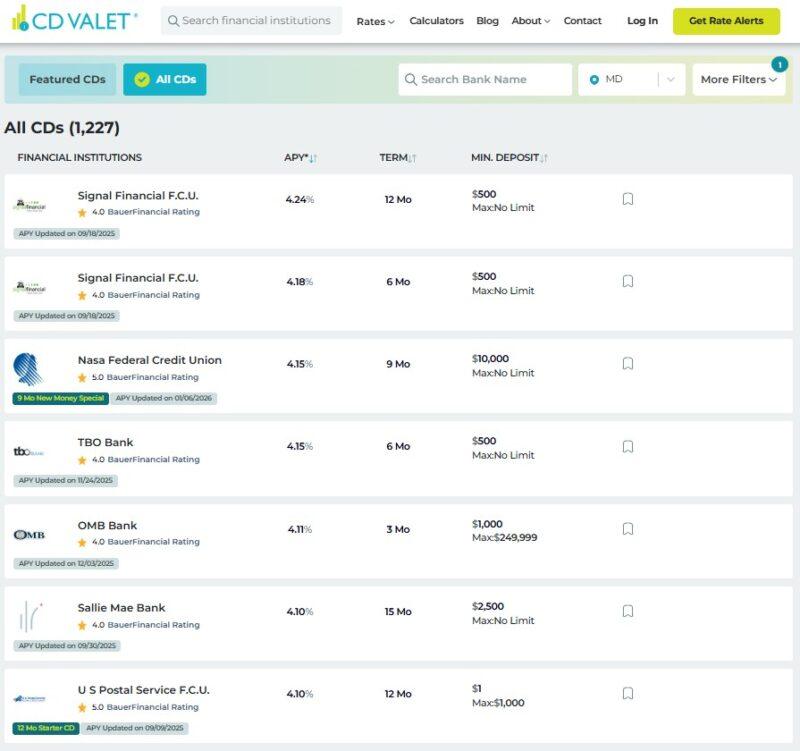

In Maryland, I found a Signal Financial F.C.U. with a 4.24% APY 12-month CD that’s slightly better than the best CD rates available right now nationwide (currently an Alliant Credit Union 12-month CD at 4.00% APY). I am able to join Signal by donating $5 to their charitable foundation and because I live in Maryland.

You never know where a high rate will be. Credit unions tend to have slightly better rates than national banks. Local credit unions tend to have better rates than nationally available credit unions. And unless you plan to look up all your local rates, you won’t find them.

Table of Contents

How I’d Use CD Valet

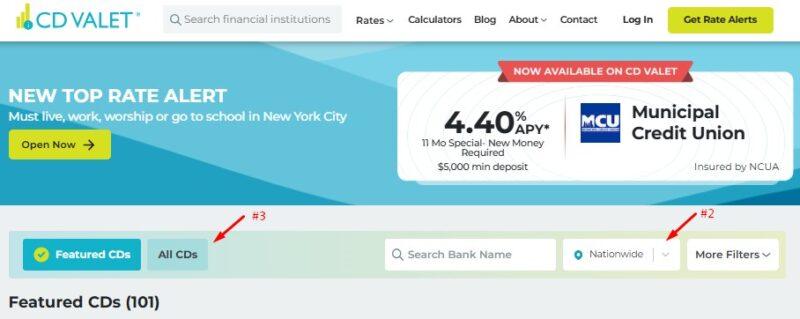

If I were looking for a 12-month CD, this is exactly how I’d use it.

- Go to CD Valet

- Switch the search to Maryland

- Click on All CDs

4. Review the CDs!

In some cases, likely where CD Valet and the financial institution have a marketing relationship, you’ll see a green Open Now button. You can click on that to open.

If there isn’t that button, do a Google search for the bank and open it directly.

Who is CD Valet For?

If you’re looking for the best CD rates but don’t want to (or don’t have the time to) do the research yourself, CD Valet is a good tool for the job.

If you’re saving lots of money, where 0.25% to 0.50% bump on your yield makes a difference, a quick check of CD Valet will give you confidence you’re picking the right bank.

It’s not for folks who don’t want to jump through hoops because many of the highest rates will be from smaller credit unions with strict eligibility rules. Even the ones that don’t have strict rules, like Signal Financial FCU, you may have to make a small donation or join an organization to gain eligibility.

Also, if you’re not comfortable with a non-name brand bank (you won’t find Chase, Bank of America, or Wells Fargo listed too highly because their CD rates aren’t great), it’s also not a useful tool for you.

Finally, CD Valet only lists the rates. You don’t work with CD Valet in any way, you have to go to the bank or credit union directly to open an account.

Is CD Valet Safe?

Yes, perfectly safe.

CD Valet only lists rates and you never open an account with them. If you register for their email list, you get weekly updates on rate changes and other news but you don’t establish a financial relationship.

As for the institutions they list, CD Valet pulls in the BauerFinancial Rating. This is a rating system from BauerFinancial, which is an independent bank research firm that gives each bank or credit union 1 to 5 stars. 5 stars means it’s a “Superior” institution that BauerFinancial recommends and 1 star means it’s troubled. I find these ratings to be superfluous because the financial institutions are covered by FDIC or NCUA insurance.

What you see on CD Valet is what you will see on the bank or credit union website. CD Valet just lists them in one place so you can compare them against others.

CD Valet vs. Raisin

One natural comparison is versus Raisin. Raisin is a financial technology company that offers banking services with higher yield through its partner banks. When you view rates on Raisin, you’re seeing special rates that they’ve negotiated with banks and credit unions.

With Raisin, you open an account and actually deposit money with Raisin. Raisin gets you access to higher rates from their partner banks because the banks are looking to secure more deposits. Your money is put with other Raisin customers and placed in a pooled account at the institution. You have access to it but you never have a relationship with the bank itself and you get pass-through FDIC/NCUA insurance.

✨ Related: Read our Raisin review for more.

With CD Valet, you work directly with the banks and credit unions. CD Valet just lists the rates. So when you want to open an account, you have to go to the bank and credit union. The account will be in your name, not pooled, and you are a known customer to the institution.

CD Valet vs. Other Sites

There are other rate sites but most of them focus solely on nationally available rates. They don’t drill down into state specific or into credit unions.

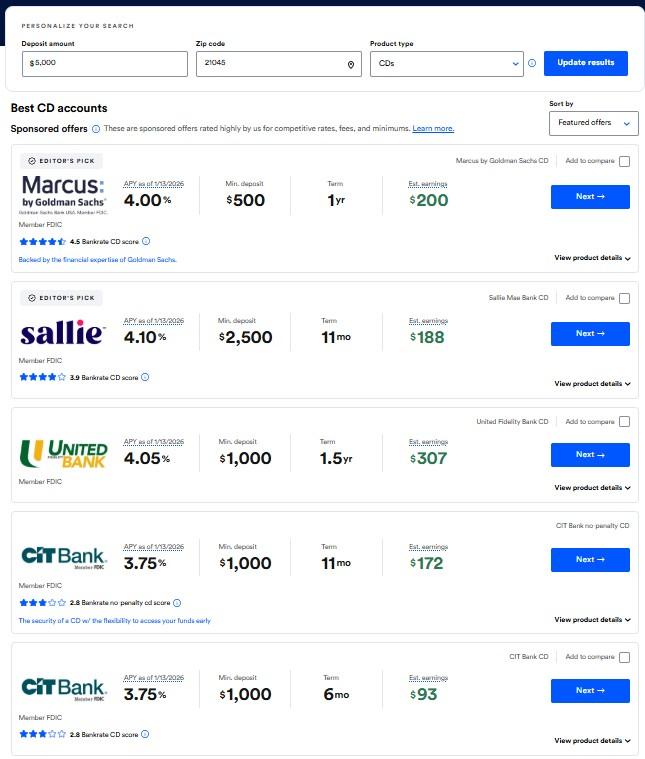

Bankrate, which started as a rate listing service in newspapers, tends to only list nationally available rates nowadays. You can enter in your zip code but it’s not surfacing rates from small credit unions.

I looked for rates in 21045 (Columbia, MD) and it showed me:

This is what CD Valet showed for Maryland:

CD Valet showed me four credit unions with higher rates than anything on Bankrate’s list and it wasn’t until Sallie Mae Bank that the two lists matched.

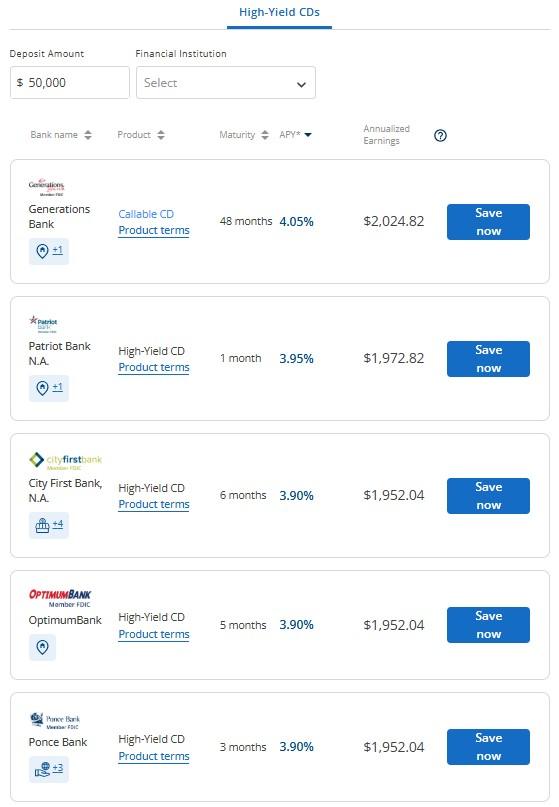

For comparison’s sake, here’s Raisin’s list:

As you can see, CD Valet still comes out on top in terms of rates though you could argue Raisin makes it easier to open an account with each bank if you’re comfortable with FDIC/NCUA pass-through insurance.

Is CD Valet Worth It?

It’s a listing of the best rates and they survey thousands of financial institutions, it’s certainly worth a free peek to see if you can get a better rate on your CDs.

Many of the rates are slightly higher than what you can get from online banks. For example, my Ally Bank CD rates seem to lag what’s listed on CD Valet by around 25 basis points.

While it may not make sense for me to open up an entirely new account just to get 25 basis points on a CD, someone with plenty of time and on a fixed income may find it valuable to do so.

But you only know what the highest rates are if you can find a trusted source for it and for me, that source is CD Valet.