One of the ironies of credit is that it’s hard to establish. Credit card companies won’t give you a card if you don’t have good credit and you can’t build credit unless you get a credit card.

To get around this, you forced to use sub-optimal credit cards, like a store branded credit card or a student credit card, until you build credit. The rewards aren’t as good, the fees may be slightly higher, and your credit limit will be small.

It’s a minor inconvenience but what if there was a better way?

There is and it’s something I plan to do for our kids when they’re old enough.

Add them as authorized users on your credit cards, but then stick the cards in the drawer. 😂

💡 FYI, you can add anyone as an authorized user. It doesn’t have to be your child. But if you are going to do this as a favor to someone, remember that YOU are on the hook for the charges – not the authorized user.

Table of Contents

Why You Should Add Your Children as Authorized Users

The strategy is simple – establish credit by giving your kids access to your credit cards. For years, this strategy was known as “piggybacking” and you even had folks “renting” their authorized user spots out to strangers (but not give them the card).

When you add a someone (child or adult) as an authorized user, it will get reported to the credit bureaus. This will establish that line of credit on their report and they begin to build credit for that person.

When you add a minor, some issuers will report it and some will not. Some issuers will not ask for a social security number but there are still ways to get that information to a file based on name, age, and addresses. As long as there is no cost to adding a user, it’s worth the “risk.”

When you add your children as authorized users, you are effectively giving them access to your credit cards and extending your good credit to their non-existent credit. They can get cards they otherwise wouldn’t have qualified for, which is a good thing.

Are there other risks to this? Besides the risk of not having the credit card appearing on their report, the only other risk is that they are irresponsible with the card. You are responsible for their actions, so you’ll want to monitor this closely. (in fact, the authorized user is actually NOT legally responsible)

Also, many card issuers do not itemize the authorized user’s charges. It’ll all appear together on your statement. This can be difficult if you want to figure out who is charging what and you have a lot of authorized users.

While you should never co-sign a loan with your kids, making them authorized users on your credit cards sounds similar but slightly different. First, with a loan, the balance is large and immediately. With credit cards, it’s $0 until they start charging. You’re on the hook in both instances though.

The solution to this risk is that you don’t give them the card. Zero risk. 😉

Is Piggybacking Worth It?

Yes – only because it’s easy. Just add your children as authorized users and then stick the card in your drawer.

They get a start on their credit history and it comes at no cost to you.

You don’t have to start doing this when they’re really young though. Even starting at 15 will give them a huge advantage when they turn 18. Three years of credit history is huge.

Even if you start at 16 and give then two years – that’s better than when they start at 18 with zero years.

Also, recall that the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009 made getting a credit card just a little bit harder for those under 21. If you want a card, you need to have proof of income or get a co-signer.

How to Add an Authorized User

Most card issues let you add a new authorized user online.

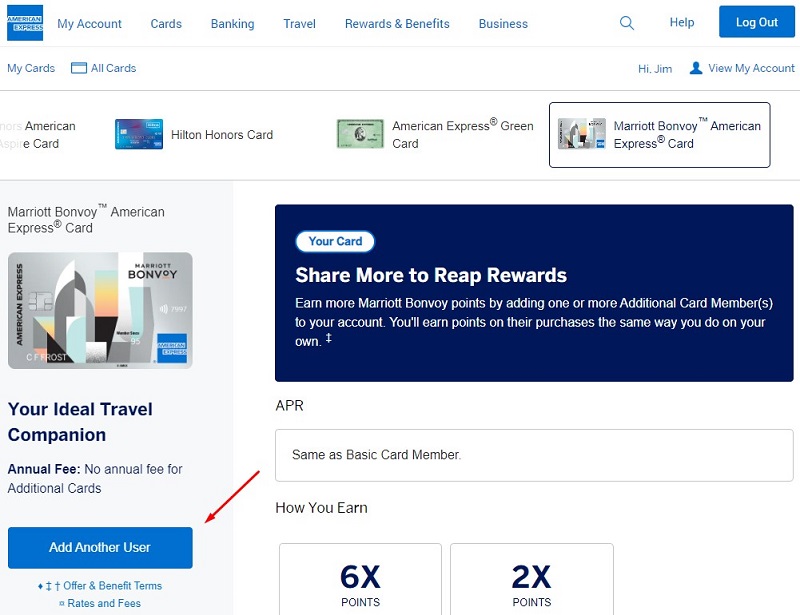

When I log into my American Express account, I see a big blue Add Another User right on the dashboard for my Marriott Bonvoy American Express Card:

Clicking that button takes you immediately to a page where you can request new users.

Other issuers have a less clear way to add new users, such as U.S. Bank.

To add an authorized user to your credit card there, these are the instructions:

- Select Customer Service from the top of the page, then choose Self Service.

- Within the Credit Cards, Charge Cards and Personal Lines section, select Add Authorized User. If you have multiple credit cards, select the card you’d like to add an authorized user to. Then select Continue.

- Fill out the authorized user form and select Continue to review.

- Take a look at the information and if it’s correct select Submit authorized user request.

Or you can do it through the mobile app:

- From the account dashboard, select the Menu in the upper left corner, then Manage cards. (Make sure to select the correct card if you have more than one.)

- Select Add authorized user from the card controls menu.

- Fill out the new authorized user form and select Continue to review.

- Review the information, then select Submit authorized user request.

Minimum Age for Authorized Users by Credit Card

Every issuer differs on how old someone needs to be to get added as an authorized user. The consensus tends to be there is either no minimum age or 13.

| Card Issuer | Minimum Age | Maximum # Authorized Users Per Card |

Reports to Agencies? |

|---|---|---|---|

| American Express | 13 | 4 | No |

| Bank of America | None | Unknown | Yes |

| Barclays | 13 | 4 | Yes |

| Capital One | None | No limit | Yes |

| Chase | None | No limit | No |

| Citi | None | Unknown | Yes |

| Discover | 15 | 5 | Yes |

| U.S. Bank | 13 | 7 | Yes, over 16 |

| USAA | None | 10 | Yes |

| Wells Fargo | None | Unknown | No |

For the “Reports to Agencies?” column, all cards report to agencies if you are 18 or older. It was difficult to find information for some on whether they report minor authorized user behavior to bureaus.

For what it’s worth, Chase, Citi and Capital One don’t collected Social Security Numbers for those under 18. It’s still possible for the bureaus to get the data despite not knowing the Social Security Number.

Not All Issuers Report Authorized Users

Not every issuer will report an authorized user to the credit bureaus.

For example, American Express says that “you can help your child establish credit if they are 18 or older.” – which implies they don’t report anything if your child is under 18. I couldn’t find a page that explicitly stated they didn’t report it.

Chase explicitly states that they do not report authorized user credit history of minors. So does Wells Fargo.

Since many cards don’t charge an annual fee to add an authorized user, it’s not a huge problem if you add your child and it doesn’t get reported.

Best Card to Add Authorized Users

USAA is the best card to add authorized users because they have no age restrictions and report it to all the credit bureaus.

If you don’t have a USAA card, then the next best one was a Barclays card.

Barclays will allow authorized users as young as 13 and Barclays states in their standard credit agreement that “Barclay’s provides account information to the credit reporting agencies for all account users.”

Next is Discover Card at the age of 15. Discover makes it a point to explain that they will report information to all the credit bureaus and they only allow you to add an authorized user when they are 15.

If your children are older, especially if they are 18 or older, then you can use any card that works best for your situation. Once they are 18, all credit cards report behavior to the bureaus.

Personally, if I didn’t have a USAA, Barclays or Discover card, I wouldn’t get one specifically to add our children. I can wait until they are old enough for another issuer, or at least when they will report that behavior to the bureaus.