E*TRADE is a longstanding online brokerage that caters to beginner investors and experienced traders alike. It also offers managed portfolios for those looking for an automated investment solution. But with no fractional shares or crypto trading capability, it may not be the best option for some investors.

Our E*TRADE review covers the key features, pricing, pros and cons, and some E*Trade alternatives.

Table of Contents

- What Is E*TRADE?

- Key E*TRADE Features

- Trading Platforms

- Basic Trading

- Power E*TRADE Platform

- Stock Quotes

- Charting Tools

- Options Trading

- Futures Trading

- Paper Trading

- Stock Screener

- Analyst Reports

- Portfolio Analyzer

- Educational Resources

- E*Trade Core Portfolios

- E*TRADE Pricing

- E*TRADE Promo Code

- E*TRADE Pros and Cons

- E*TRADE Alternatives

- FAQs

- Who Should Use E*Trade?

What Is E*TRADE?

E*Trade from Morgan Stanley is an online brokerage that features commission-free stock or ETF trades, a wide variety of investment options, and managed investment portfolios.

It has approximately 5.2 million customers and $460 billion in assets under management, and it is among the five biggest discount brokerages in the U.S.

E*Trade began offering internet-based stock trading in 1996 and was known for its affordable pricing and investment options. Morgan Stanley finalized its acquisition of E*Trade in 2020.

Key E*TRADE Features

E*Trade is a popular platform with beginner investors, but experienced traders can benefit from its Power E-Trade platform. Here’s a closer look at some of E*Trade’s key features:

Investment Options

E*Trade account holders can trade the following securities on its platform:

Unfortunately, E*Trade doesn’t support fractional shares, so you will need to buy and sell full shares of stocks and ETFs. However, you can reinvest dividends for free courtesy of E*Trade’s dividend reinvestment plan (DRIP).

E*Trade doesn’t allow you to trade crypto tokens, such as Bitcoin or Ethereum. However, you can purchase crypto-linked funds and stocks trading on the stock market like the Grayscale Bitcoin Trust (GBTC). That said, crypto traders will want to look elsewhere.

Account Types

With E*Trade, you can open the following taxable and tax-advantaged brokerage accounts.

- Brokerage

- Coverdell ESA

- Custodial Account (brokerage account for a minor)

- Core Portfolios (managed investing)

- Traditional IRA

- Roth IRA

- Rollover IRA

- Beneficiary IRA

- E*Trade Complete IRA

- IRA for Minors (children with earned income)

- Premium Savings Account

- Max-Rate Checking

In addition, E*Trade offers multiple investment accounts for business owners.

Note that margin traders can borrow up to 50% of their eligible equity to buy securities. Interest charges apply and depend on the balance.

The E*TRADE Premium Savings Account through Morgan Stanley Private Bank (FDIC Cert # 34221) earns a high savings interest rate and provides up to $500,000 in FDIC Insurance ($1 million for joint accounts). This way, you can easily park your short-term cash while allocating the rest of your portfolio to long-term holdings.

Trading Platforms

All E*Trade users have complimentary access to E*TRADE’s web and mobile platforms. Most investors will find the features and customizable layout more than sufficient for trading stock, options, and funds.

Basic Trading

E*Trade’s basic trading platform makes it easy to manage your accounts, review market news, and research potential investments. Options traders can analyze chains, back-test, and use professional-grade screens.

Power E*TRADE Platform

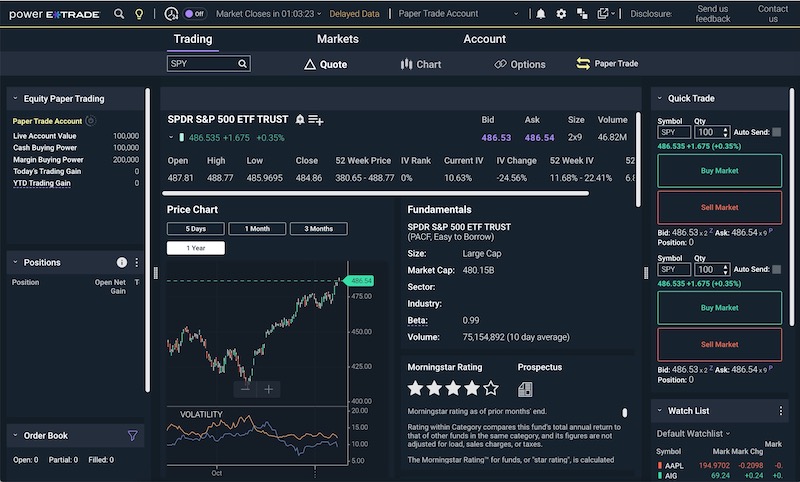

Dedicated traders who utilize more complex trading strategies should opt for the advanced Power E*TRADE platform, which offers more robust charting tools and technical screeners. It’s complimentary and available for web, Android, and iOS devices.

Some of the platform’s features include:

- Earnings move analyzer

- Exit plan (enter profit target and stop loss while creating orders)

- Over 145 chart studies and drawing tools

- Risk/reward probabilities

- Technical pattern recognition

After logging in, you can launch Power E*Trade by tapping “Launch” to open a new streaming window.

You can customize the layout by dragging data feeds. You can also choose between a white or black background. Frequent traders may prefer a downloadable platform, but the web edition and mobile app are quick and offer a seamless experience from the home, office, or on the go.

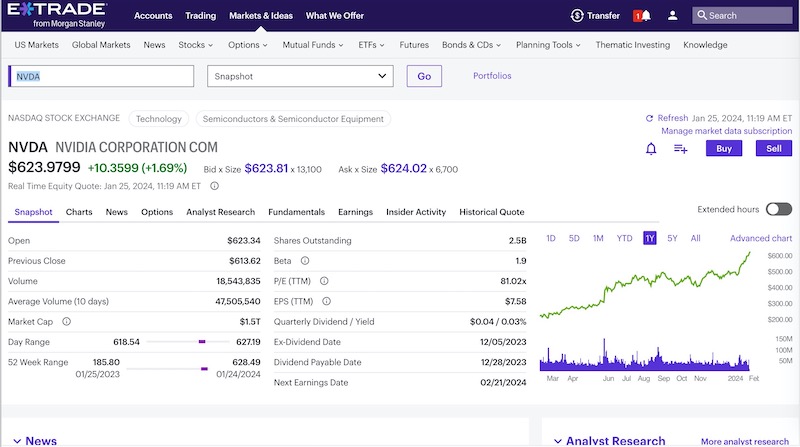

Stock Quotes

You can find plenty of fundamental, technical, and company-specific details with the stock quote research tabs. There are many different indicators and data feeds, including:

- Price history

- Charts

- Earnings

- Fundamentals

- Insider activity

- Price analysis

- News

- Analyst ratings

- Social sentiment

Most of these features are competitive with most full-service online brokerages, like Fidelity or Schwab. Needless to say, the tools are far more extensive than micro-investing apps such as M1 Finance or Robinhood, which paved the way for free trading but lack in-depth research capacity.

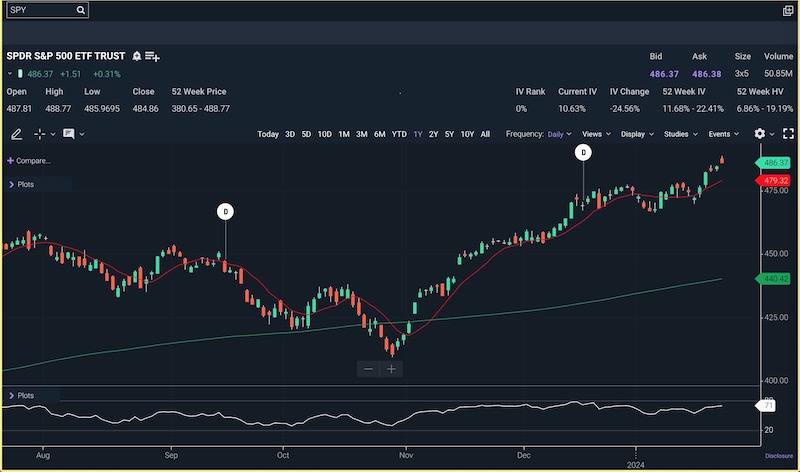

Charting Tools

I find reading stock charts easy with the standard and Power platforms. You can draw trendlines along with selecting multiple upper and lower indicators. The software lets you compare several tickers in the same chart and add key events and dividend dates quickly. There’s also an option to produce printer-friendly charts.

The Power E*TRADE charts rival the best stock charting software and can help you find technical patterns. Frequent charters will naturally gravitate to this platform for stocks and funds.

Options Trading

If you’re looking for extensive options trading tools, this is an excellent platform. They include:

- Options chain

- Options analyzer

- Income backtester

- Income finder

- Options screener

- Probability calculator

- Strategy optimizer

You can research options with the standard and Power platforms. In some regards, I find the Power E*Trade options analysis tools more straightforward to use than the highly-accoladed thinkorswim platform. However that conclusion may depend on personal preferences.

Futures Trading

E*Trade offers futures trading in its brokerage and eligible IRA accounts. This allows you to diversify your holdings into metals, energies, interest rates, and currencies. You can trade futures listed on CME, ICE, US, and CFE, nearly around the clock, with access 24 hours a day, six days a week. E*Trade also offers support from licensed Futures Specialists.

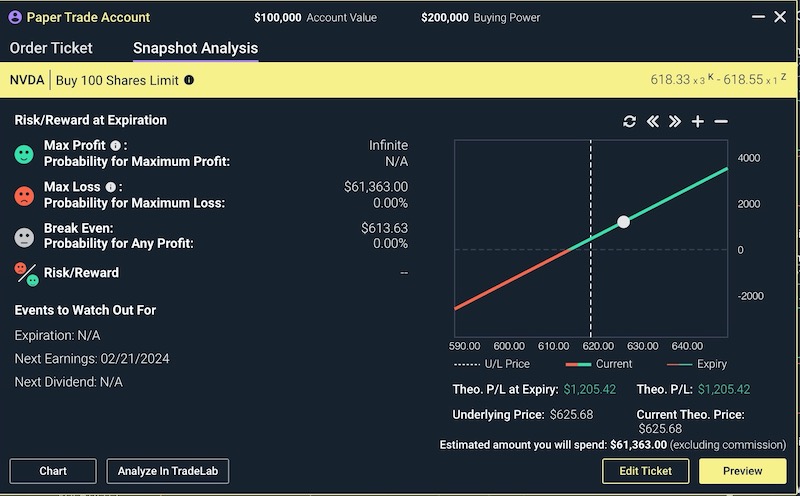

Paper Trading

The Power E*TRADE platform offers a free paper trading account, which allows you to practice different stock and options strategies. I like that you can simulate trades and calculate probabilities with the snapshot analysis and TradeLab tools.

Stock Screener

The E*TRADE stock screener lets you build custom screens or choose from predefined strategies. Filters include company size, rating by analysis service, fundamentals, technical, earnings, and dividends.

This tool competes with the best stock screeners, allowing you to quickly compare stocks and funds that you may decide to research further.

Analyst Reports

If you like reading analyst research reports, you can view recurring publications from Argus, Morgan Stanley, SmartConsensus, TipRanks, and others. You can also access market commentary and get general data on market statistics, upcoming market calendar events, and sector analysis.

These fundamental and technical reports are a nice complement to stock newsletters for finding investment ideas.

Portfolio Analyzer

Unlike more basic trading apps, E*Trade has a built-in portfolio analyzer. This lets you review your asset allocation, risk grade (conservative, moderate, and aggressive), and income estimator.

The portfolio tools also make it easy to track stock performance for current holdings and those on your watchlist.

Educational Resources

Beginner investors will appreciate E*Trade’s knowledge center, which introduces basic investing concepts along with advanced strategies through videos and articles. Live and on-demand webcasts are conducted throughout the year too. These resources are similar to most longstanding online brokers.

E*Trade Core Portfolios

In addition to its stock trading platform, E*Trade offers its pre-built Core Portfolios for investors who prefer a more hands-off approach. You can start with as little as $500, and E*Trade will keep track of your portfolio and do all of the rebalancing for you. The following account types are eligible for Core Portfolios:

Brokerage Accounts:

- Individual

- Joint

- Custodial

Retirement Accounts:

- Rollover IRA

- Traditional IRA

- Roth IRA

Core Portfolios are comprised of low-cost ETFs, including tax-efficient options for taxable accounts. Investors can customize their portfolios with SRI and ESG options.

E*TRADE Pricing

As mentioned, E*Trade offers commission-free stock, options, mutual funds, and ETF trades. Here is a full list of trading fees:

- Stocks, options, mutual funds, and ETFs: $0 per trade

- Options contracts: $0.65 per contract ($0.50 per contract with at least 30 trades per quarter)

- OTC stocks: $6.95 ($4.95 when executing at least 30 stock, ETF, and options trades per quarter)

- Bonds: $1 per bond ($10 minimum and $250 maximum)

- Futures: $1.50 per contract plus fees ($2.50 for cryptocurrency futures)

- Core Portfolios: 0.30% annual fee on balances above $500

- Broker-assisted trades: $20 to $25 per trade

E*Trade’s pricing is similar to most online brokerages. Additionally, there are no funding minimums or ongoing balance requirements. Two notable exceptions are a $500 minimum to open a fully automated Core Portfolio and a $25,000 minimum to avoid pattern day trader restrictions.

You may encounter some account maintenance fees. The most common charges include:

- Account closing transfer fee: $75 for full transfers

- Forced margin liquidation: $25

- Paper statement fee: $2 per monthly statement

- Wire transfers: $0 incoming and $25 outgoing

There are continuous E*TRADE promotions for new customers to earn bonus cash by making qualifying deposits within the first 60 days.

Be sure to enter the current promo code during the signup process to become eligible. You can check out our list of the best new brokerage account promotions here.

E*TRADE Pros and Cons

Pros

- No fees to trade stocks, ETFs, and mutual funds

- Easy-to-use web and mobile platforms

- Plenty of fundamental and technical research tools

- Paper trading and options analyzers

- Managed investing with E*Trade Core Portfolios

Cons

- Can’t purchase fractional shares

- Can’t trade crypto tokens, e.g., Bitcoin, Ethereum

- No downloadable desktop software

E*TRADE Alternatives

These powerful E*TRADE alternatives may provide different investment options, research tools, and platform features that can be a better fit. For example, most offer fractional investing.

Fidelity Investments

Fidelity is the largest online broker by assets under management, and it’s a great option for investors with any experience level or strategy. The web platform provides analyst reports, excellent charting tools, and advanced trading software.

Members can enjoy index mutual funds with no minimum investment or management fees.

Additionally, you can buy fractional shares of U.S. stocks and ETFs with a minimum $1 investment through the Fidelity mobile app. There are no trading fees for most investments.

👉 Here are the latest Fidelity Investments promotions

Schwab

Schwab is another large discount brokerage offering commission-free trading and the ability to buy S&P 500 stocks for as little as $5. Its trading platforms and research tools are among the best in the business, especially after its recent acquisition of TD Ameritrade.

This includes thinkorswim, Ameritrade’s fully customizable trading platform that is available via desktop, web, or mobile app.

👉 Check out the latest Charles Schwab promotions.

Interactive Brokers

Interactive Brokers is ideal for technical traders who need robust charting software. Pricing starts as low as $0 on stock trades with the IBKR Lite plan, although frequent traders may pay small fees per share. There are desktop, mobile, and web platforms.

TradeStation

Beginner and advanced traders can benefit from the TradeStation charting and trading tools. There are desktop, mobile, and web apps.

In addition to stocks and ETFs, you can trade futures and crypto that E*TRADE may not offer.

Read our TradeStation review for more.

👉 Get started with TradeStation.

WeBull

WeBull offers stocks, options, ETFs, futures, and margin trading. Fractional shares start at $5 and are tradeable through the web, mobile app, and desktop version. You can also enjoy free paper trading and purchase advanced market data streams.

The WeBull free stock promotions are also worth taking a look at as you can collect several free shares with qualifying deposits.

Read our WeBull review for more.

👉 Get started with Webull.

FAQs

Yes, E*TRADE is one of the better choices for new investors as you won’t pay trading fees for stocks, ETFs, and index funds. There are plenty of research tools, investment options, and an extensive yet easy-to-navigate user experience that more basic investing apps don’t offer.

Yes, E*TRADE is one of the oldest online brokerages with a large user community of new and experienced investors. Additionally, accounts are SIPC-insured and FDIC-insured if the brokerage closes, although normal market losses are non-reimbursable.

Phone-based customer service is available 24/7 by phone. Live chat is also accessible after logging into your account. Email support and a knowledge library are available for non-urgent matters.

Prebuilt Core Portfolios are available with a minimum $500 balance. Receive a personalized asset allocation using your risk tolerance and investment goals through taxable and retirement accounts. Users also enjoy automatic rebalancing and tax-loss harvesting.

Who Should Use E*Trade?

E*Trade is a well-rounded trading app, making our list of the best online brokers for new investors while also being a solid choice for experienced traders. It offers tools and resources to serve short-term or long-term strategies and free stock trades. And its trading platform routinely wins awards for its technology and offerings.

E*Trade’s core portfolios are another nice feature if you want access to managed investment portfolios.

E*Trade’s biggest drawback may be that it doesn’t offer fractional investing, which makes it easy to invest with small amounts of money. Further, you cannot trade crypto, which may turn off traders who want to keep all of their investments under one roof.