Mint announced earlier this year that they will be shutting down at the end of the year.

Intuit has suggested that its users go to Credit Karma, another Intuit product, because they will be migrating many “Mint-like features” over to Credit Karma according to their FAQ.

“You will be able to bring the majority of your Mint financial account balances, your entire net worth history, plus all of your supported account connections and transactions. When the time comes to move your financial account data from Mint to Credit Karma, your personal information will not be moved without your consent.”

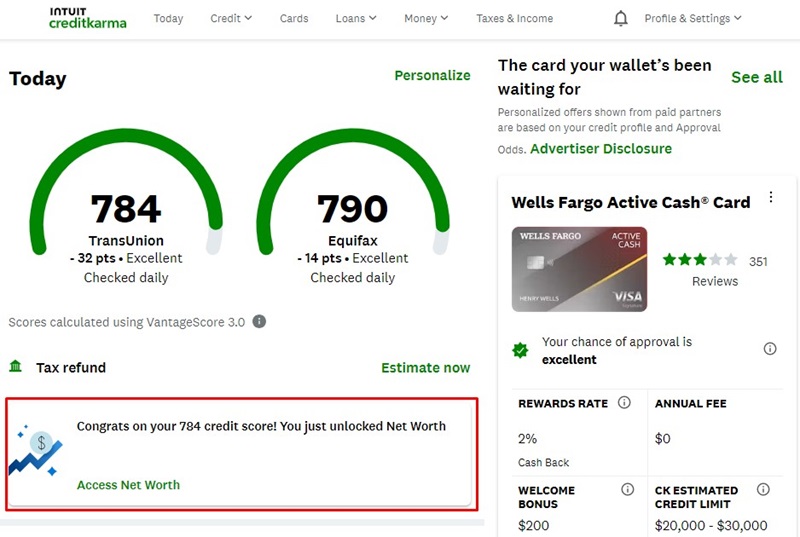

When I logged into my Credit Karma account, I did see something new (to me) that seems in line with what may be expanded with Mint’s features – the ability to track my net worth. This is a feature that was added earlier this year:

If you click it, you can start linking your accounts to confirm your net worth. On its own, not super compelling but when you start introducing Mint-like features, it could get interesting.

The bigger question though is what about Simplifi by Quicken? Simplifi by Quicken is a natural choice and they offer the ability to import transactions from Mint. If you don’t want to wait to see what features will be added to Credit Karma, you could try Simplifi for 30 days to see if it’s a good fit.

Table of Contents

Simplifi by Quicken vs. Credit Karma

It’s hard to compare this head-to-head without seeing what features will be added to Credit Karma. Right now, all we know is:

- Credit Karma is free with ads.

- Simpify by Quicken is $3.99 per month but no ads.

Right now, the only benefit is that Credit Karma is that it’s free.

For now, my guess is that those who are willing to see advertisements and product pitches in return for a free budgeting app will go to Credit Karma. Those who are willing to pay for a richer feature set (and skip the ads!) will turn to Simplifi by Quicken since it has a modest monthly fee. (Intuit does not own Simplifi by Quicken but many of the Quicken team members were former Intuit employees.)

Until Credit Karma starts showing us the features, we can’t make a comparison right now because Credit Karma only offers credit score monitoring and nascent net worth tracking. While those are good features, especially for free, Mint’s value was in budgeting, not net worth tracking.

We will update this post with more information as Credit Karma gets its new features.

Simplifi by Quicken vs. Mint

Since we don’t yet know which features will be pulled into Credit Karma, we should compare Simplifi to Mint itself to see what we gain and give up by switching over to a paid product.

- Mint was free with budgeting, transaction importing, and goals.

- Simplifi has many of the same features as Mint, but is $3.99 per month.

Simplifi by Quicken is very similar to Mint in its budgeting and transaction monitoring features. Budgets, savings goals, sharing information with other users (partner, spouse, etc.), and no advertisements. If your transactions are imported cleanly, it feels like you could make the transition pretty easily.

The biggest difference is price. Mint was free, Quicken is $3.99 per month though you can often find sales (as of this writing, they are still offering their Black Friday pricing of $2 a month, billed annually). There is no trial period, but there is a 30-day money-back guarantee, so you can try it out for a month and request a refund if you don’t like it. Since you are paying, you don’t get bombarded with ads and offers.

Read our full Simplifi by Quicken review here.

Credit Karma vs. Mint

Right now, we just have the net worth tracking, which is not exactly what Mint was offering but is closer to what other Mint alternatives have. We also have everything Credit Karma offered previously – credit score tracking, advertisements, etc.

- Credit Karma is free, and your information from Mint will be imported from Mint automatically.

The big benefit of going with Credit Karma is that the migration will be handled for you. It’s also free.

If you’re a Mint user right now, you will get an email whenever you can migrate and it will include historical data, account connections, and “the majority of your Mint financial account balances.”

Personally, I’d make sure I downloaded my Mint transactions and give the migration a try to see what I get. If it works nicely, it seems pretty easy to stay with Credit Karma because it requires so little work. If the features are not great, it’s easy to switch anyway.

What About Mint Alternatives?

What if you don’t care about staying Intuit (and former Intuit) ecosystems, is now a good time to make a switch?

If you just want budgeting and you don’t want the other stuff, you have a few options but the best ones are not free. They’re not free because many rely on Plaid to import transactions, which is an expensive service. If Mint can’t make it work with its advertisements, it’s much harder for smaller companies to do it.

Here’s our full list of Mint alternatives.

Empower

If you feel like you’ve “graduated” from budgeting and transaction monitoring and want more insight into your entire net worth, investments, retirement, and wealth you should consider Empower.

Empower Personal Dashboard is similar to what Credit Karma offers in net worth (if you’ve tried it) except they have a focus on wealth management and growth. There’s a “budgeting” component to Empower, but it’s more transaction monitoring and not the same features as you’d see in Mint or Simplifi.

The strength is in investing and planning. Empower is free, but they will try to sell you on their financial planning and wealth management services (tell them you’re not interested, and they will stop calling; if you ignore the calls, they won’t stop… they’re persistent! 😂). It’s worth a look especially since it costs nothing.

You can read our Empower Personal Dashboard Review to fully understand what they offer.

Lunch Money

For $8 a month or $80 a year, Lunch Money is a well-designed budgeting and net worth tracker that pretty much does everything Mint does without the advertisements. It’s a one-person operation, too, which is nice to support individual creators with a developer API if you want to play with your data and are handy with code. Also, there’s a Mint data importer so you can bring your information with you. There is a 14-day free trial, and you don’t need to enter a credit card to try it, so it’s worth checking out.

What to Do Next?

We can’t offer a definitive answer without seeing the features in Credit Karma but right now, I’d use this opportunity to try all the different apps to see which one you like. Credit Karma should be on the list, since the migration should be seamless and Credit Karma is free. If the features are what you need, stick with it. If they aren’t, move on.

A lot of the other services are offering migration features because they want you to switch. You’re probably not going to find a better time than now to switch (if you’re switching). And since many offer 14 or 30-day free trials, it’s a good time to take a look.

Have you decided what you’ll be doing after Mint?