Current Bank

Product Name: Current Bank

Product Description: Current Bank is a neo-bank that offers a checking and high-yield savings. It also has free cash advances and credit building features.

Summary

Current Bank has a checking account that offers early direct deposit, free cash advances, and a debit card that helps build credit. It also has a high-yield savings account that earns a competitive rate if you have direct deposit of at least $500 per month into checking.

Pros

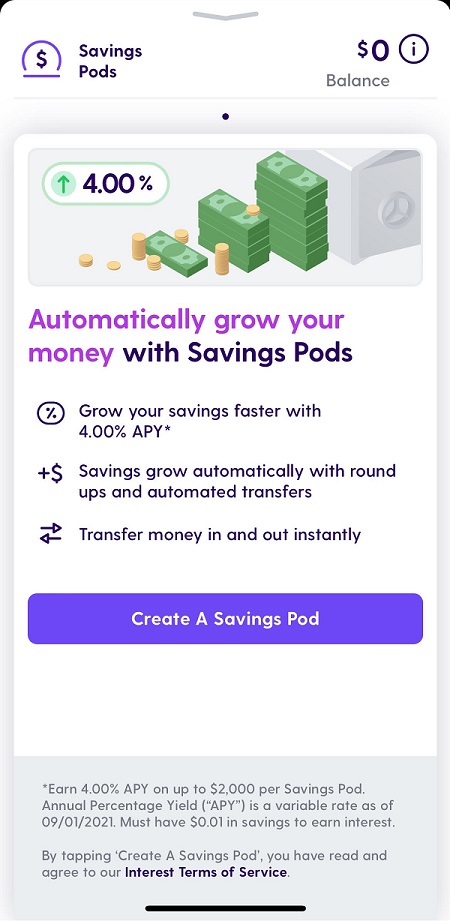

- Savings pods earn 4.00% APY on the first $2,000 (up to 3 pods)

- Get your Direct Deposit up to two days early

- Credit building features on the debit card

- Free cash advances

- Cash back rewards at select retailers

Cons

- High APY is limited to first $6,000 in savings

- No joint accounts allowed

- Mobile banking only

Current Bank is an online bank that offers a checking account, high-yield savings, and credit builder account. The checking account is packed with features including early direct deposit and free short-term loans to cover overdrafts.

With the cash advance feature, you can borrow up to $500 with no fees or interest. The credit building card is actually the debit card attached to the checking account. When you spend, the purchase amount is removed from your available balance and set aside. The funds are then used to pay the card’s bill on the due date, thereby giving you a positive payment history.

At a Glance

- Offers checking and a high-yield savings account

- Credit building features with the checking account

- Free cash advances

- Debit card can earn rewards

Who Should Use Current Bank

Current Bank is perfect for those who occasionally dip below zero in their checking account. The free cash advance could come in handy for those who need it. It’s also great for anyone looking to build their credit. The debit card functions like a normal debit card but is actually a secured card, building credit in the background.

Current Bank Alternatives

Table of Contents

Who is Current?

Current is a neobank, which simply means it’s not itself a bank. It is a fintech company that partnered with a bank to offer banking services. They focus on making the service and the app powerful while the partner bank does the banking services piece.

What bank does Current use? As of February 2024, it’s Choice Financial Group.

Current holds pass-through FDIC insurance of up to $250,000 per account via their partnership with their partner bank, Choice Financial Group (FDIC# 9423).

When you set up your account, you get an account number from Choice Financial Group. If you go to set up your direct deposit, you’ll notice the Current Routing Number of 091302966 actually belongs to Choice Financial Group.

Here is its current welcome offer:

- Get $50 when you add and receive a qualifying direct deposit of at least $200 within 45 days, plus,

- Earn 4.00% APY on up to $6,000 of your savings in their “savings pods.”

The Current cash bonus is OK (there are better offers on our bank bonus page). But their app is pretty good, and if you’re looking for a simple, easy-to-use financial app with a great yield on your saving account, Current might still be worth considering.

The company also has three customer service options: phone, email, and chat. Next, let’s go over some details on Current’s account choices.

The Current Spend Account

They used to have two tiers, Basic and Premium, but now everything is free!

The Current Account has no monthly fee and no minimum balance requirement.

Other features include:

- Build credit with your debit card

- Early direct deposit, up to 2 days, depending on your employer or payroll provider

- Budgeting tools and spending insights

- Free short-term loan, called Overdrive, for overdraft protection

- Instant notifications for purchases

Credit Building Debit Card

Technically, the debit card that comes with your spend account isn’t a debit card but a secured credit card. However, it functions just like a debit card.

The balance in your Spend account is what you can spend on the card. When you make a purchase, the money is removed from your available balance and set aside. Then, when the payment is due on your card, Current uses the funds that were set aside to pay your balance in full.

This shows a positive payment history to the credit bureaus, and you don’t have to do anything extra.

Fee-Free Overdraft

Current offers optional overdraft protection, called Overdrive, to those who qualify. You must enroll in the program and how much overdraft protection you will qualify for depends on several factors, but you must receive at least $500 per month in direct deposit to be considered.

If you spend more than you have in your Spend account, Current will advance you the amount you need to cover your purchase. This will show as a negative balance in your account. When your direct deposit hits your account, the negative balance will be cleared.

There are no fees or interest to use this service.

The Current Savings Pods

You can create up to three savings pods to help organize your savings. You can set and name savings goals and have money automatically transferred to your Savings Pods. You can also round up purchases for additional Savings Pod accumulation.

If you have at least $500 per month in direct deposit, then you can earn 4.00% APY on up to $2,000 per pod. So you could earn a high interest rate of up to $6,000.

Once you have a Spend account, you can open a Savings Pod in the app. Just scroll down and tap on “Savings Pods.”

The Current Teen Account

Current also offers a Teen Account. This account must be established through a parent Basic or Premium account. The teen account has the following features:

- A White or Black debit card

- Standard direct deposits

- $0 minimum balance requirement

- Parental notifications for purchases

- Instant transfer of funds from the parent account

- Parental control over spending limits

Current’s Teen account also comes with a feature that allows parents to set up and pay for weekly chores that are completed.

Using this feature can be a great way to teach your teen how to earn and spend money.

Note that to open a Teen account (or any other account) with Current, you will need to provide a valid ID. Current counts the following as valid IDs:

- A current, unexpired state driver’s license or ID card

- A current, unexpired passport or passport card

- A current, unexpired permanent resident card

If your teen doesn’t possess one of the above-mentioned ID forms, they cannot open a teen account with current.

The Current Invest Account

Current also has an Invest account that gives you the ability to invest in crypto. There are no trading fees and you can invest in a variety of coins, from the big names like Bitcoin and Ethereum, to a few of the smaller ones too, like Polkadot.

Opening a Current Account

The process for opening a Current Personal Account took only a few minutes. Simply click through to the Current website and enter your phone number. There is a bonus right now and that code is automatically entered.

Current will text you a link to the app store where you download the app.

Click through, pick your account, enter in some personal information, and you’re pretty much set up.

It’s important to set up Savings Pods at some point because that’s how you get the higher interest rate:

What Else Should I Know About Current?

Here are some other things you should know about using Current. they aren’t deal breakers for me, but they may be for you:

No Check Writing

Current does not issue checks nor do they allow check writing from your Current account at this time. You can only access funds via ATM withdrawals or debit card purchases.

This can be a minor inconvenience but since you can use a debit card, I don’t see it has a huge deal.

Current Pay

Current Pay is Current’s P2P transfer system. It allows you to send or request money from other Current members. You can use it to split dinner bills, pay friends money you owe, receive money you’re owed, and more. I don’t see myself using this instead of Venmo.

Referral Program

Current also has a referral bonus program. If you refer a friend to open a Current account using the Invite & Earn Money section of your app, Current will reward you with a referral bonus after the account gets opened.

At the time of this writing, the referral bonus is $50 for you and your friend when they set up a direct deposit – it’s similar to the openly available one.

ATM and Debit Card Purchase Limits

Current has daily limits for using your Current card;

- The daily ATM limit is $500 for all accounts.

- The daily debit card purchase limit is $2,000 for all accounts.

For teen accounts, parents can lower these limits.

Debit Card Rewards Program

Current recently implemented a rewards program for account owners. When you shop at participating retailers using your debit card, you can earn up to 15x rewards depending on your account and the retailer.

The rewards cash is deposited directly into your Current account.

Alternatives to Current

If Current is appealing but you are curious what might be out there, here are a few alternatives that compare to Current.

Chime

Like Current, Chime is a mobile app. It offers a fee-free checking account and a high-yield savings account. Its SpotMe® feature also offers free short-term loans up to $200 to cover overdrafts. You can round up checking account purchases to increase your savings balance too, just like you can with Current.

For those looking to build credit, it offers a credit builder Visa card, which works as a secured card and reports to all three credit bureaus. For more information on how to rebuild your credit, see our article on rebuilding your credit with secured credit cards.

See our Chime Bank Account Review for more information on Chime.

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank or Stride Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted. Please see back of your Card for its issuing bank.

Varo

Varo is also similar to Current. It offers a spending account and interest-free cash advances up to $500, but there is a fee for the advance. It also offers a high-yield savings account and a credit builder account.

The credit builder is a secured credit card that works like a prepaid debit card. Transfer money from checking on to the card, which is then the amount you can spend on the card. When the bill is due, Varo can use your deposit to pay the bill, and report a positive payment history to the credit bureaus.

Here’s our full Varo review to learn more.

Dave

Dave offers a checking account and high-yield savings account for a membership fee of $1 per month. It also offers cash advances up to $500.

The cash advances aren’t necessarily only to cover overdrafts, and you can get a cash advance, even if you don’t have a checking account with Dave. The cash advances are free with the option to leave a tip upon repayment.

Dave doesn’t have any credit-building features, but it does have features to help you earn more through side hustles.

Summary

The Current mobile banking app can be a great way for you to use mobile banking and get your Direct Deposit up to two days early.

And if you’re searching for a teen account that gives your teen a chance to learn about money management yet still allows for parental controls on spending, Current could work for you as well.

What do you think about Current and its mobile banking features? Have you ever banked using Current? Feel free to share your thoughts in the comments section.